Asset Class Returns - 7/31/2019

What a boring month… except for the last afternoon!

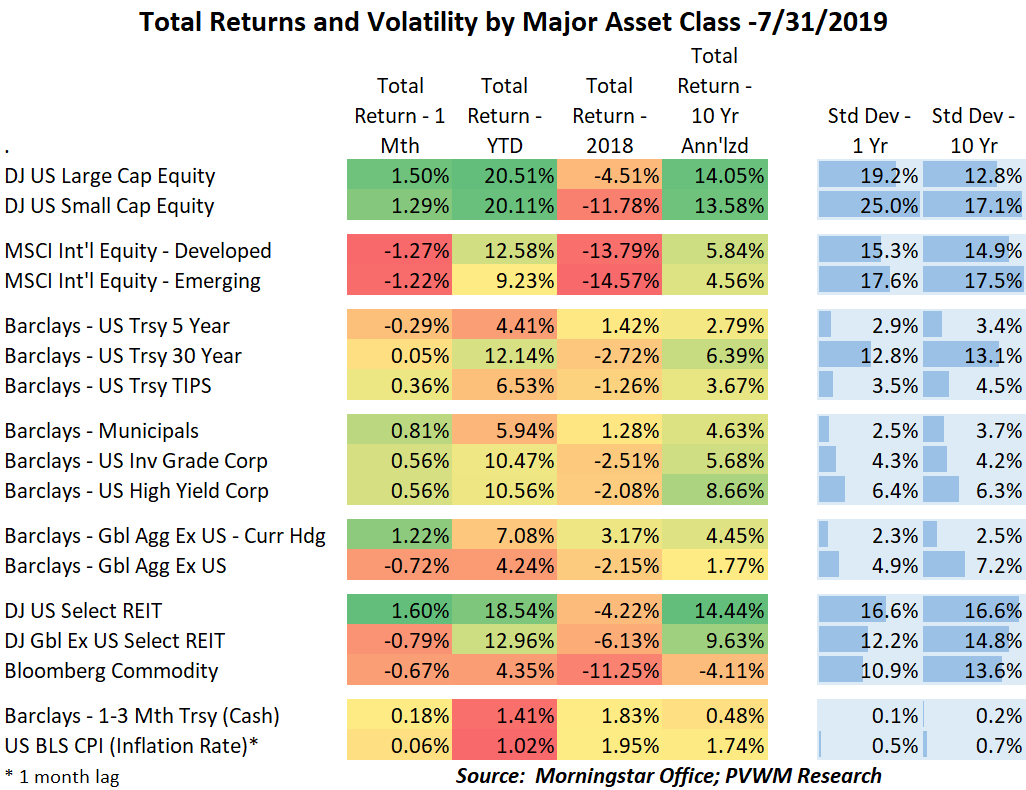

The monthly returns below across all major asset classes will look quite boring relative to the past months’ activity. The range saw a high of +1.60 for US REITs and a low of -1.27% for international equity. Even bonds, which you expect to be “boring”, didn’t see much variation across maturity (5yr v. 30yr Treasury) and credit quality (investment grade v. high yield).

With the benefit of seeing the first 1.33 days of August this is not continuing!

But back to the month recap…

US equities were up slightly. Large caps were running ahead of small caps during the month but small caps caught up late month. At the beginning of the month, Fed Chair Powell all but confirmed a rate cut during the semi-annual Congressional testimony. The market priced in that and more. 2nd quarter earnings also dominated the month with overall strong earnings and favorable outlooks. This reinforces the view of a generally strong underlying domestic economy. At the sector level, four sectors – Tech, Staples, Financials and Communications Services – had returns at 2.5% and above. On the negative side, Energy got hit on lower demand concerns and Health Care was also negative from poor drug company performance around results of testing trials or mergers.

Wait a minute… Communications Services Sector was strong?! Note this used to be called the Telecom sector which was small and dominated by Verizon and AT&T. In 2019 this new sector was created. It still contains Verizon and AT&T, but also contains companies related to new forms of communication – Facebook, Alphabet (Google parent), Netflix and Disney among others.

This is a good time for a public service announcement: “Be sure you know what stocks are inside the ETFs you are buying. Now back to your ‘not-so-regularly-scheduled' programming…”

International equities were down slightly. This captures many different markets and dynamics, a few of which are Brexit related concerns renewed with new leader, Central bank leadership changes and slower economic growth.

The bond market was also relatively boring. Treasury rates initially fell after Fed Chair Powell’s testimony to Congress early in the month all but confirmed the Fed was going to cut rates at the end of July. However, the market had already priced that in and even more cuts after the July meeting. During the month rates drifted upward as the market backed off a little on the amount of additional cuts. The actual FOMC meeting on July 31st did in fact deliver the 0.25% (25 basis point) cut. However, during the press conference following there was a reference to a “mid-cycle adjustment” implying that maybe it was a single rate cut then hold. Powell has always indicated they will be data dependent, but that data is now more explicitly focused on “the implications of global developments for the economic outlook as well as muted inflation pressures” as stated in the FOMC statement. Low inflation is good, but concerns of falling into no growth or inflation and not being able to get up (think Japan in the past) is also weighing heavy on the Fed's thinking.

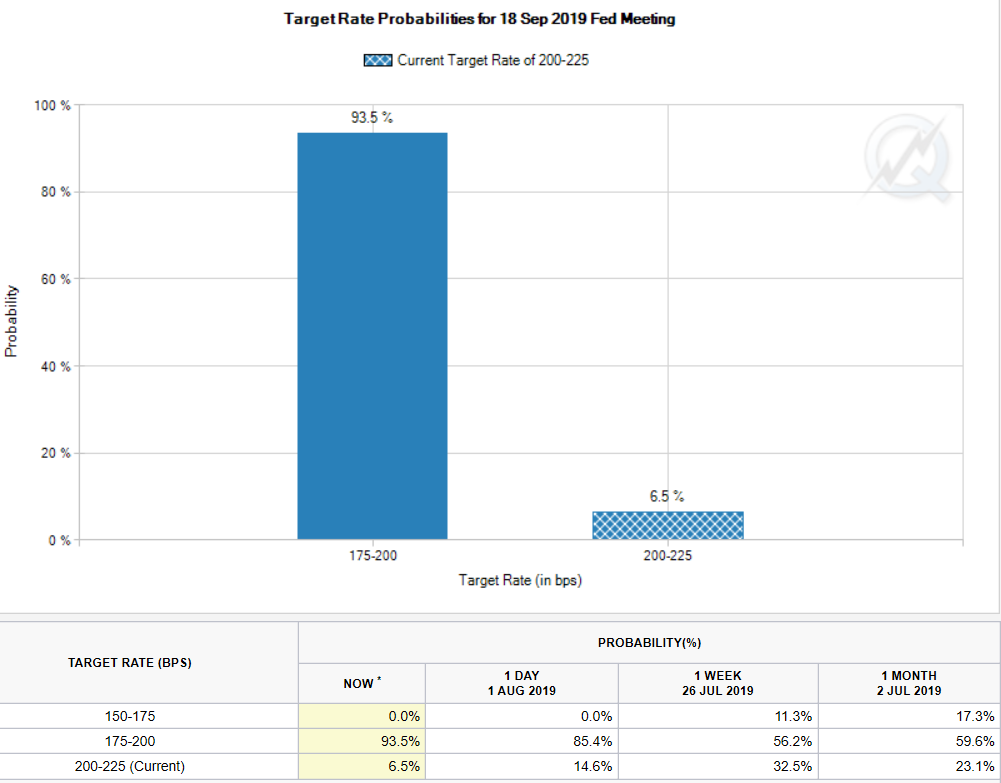

Using the CME Group FEDWATCH tool, you can see in the chart below that as of 8/2/19, the market is pricing in another 25 basis point cut at the Sep 18st meeting. What is interesting to me is the change in implied probability for the number of cuts in the table at the bottom of that chart. Early in July (when 225-250 was ‘Current’) the market was pricing in as much as three 25 basis point rate cuts by September. After the Fed meeting that third rate cut was priced out given the press conference after the meeting. Now on August 2nd there is a near certain additional cut being priced in after trade negotiation developments yesterday.

If there was any doubt about the impact of fewer rate cuts on equity markets, note the sell-off that was triggered during Powell’s press conference when he mentioned “mid-cycle adjustment” implying a potential one-and-done. The first two days of August have been dominated by trade negotiations however, though we also had another solid (but not great) jobs report for July.

Enjoy the ice-cream and beaches.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com