Asset Class Returns - 6/30/2019

Merry Christmas!

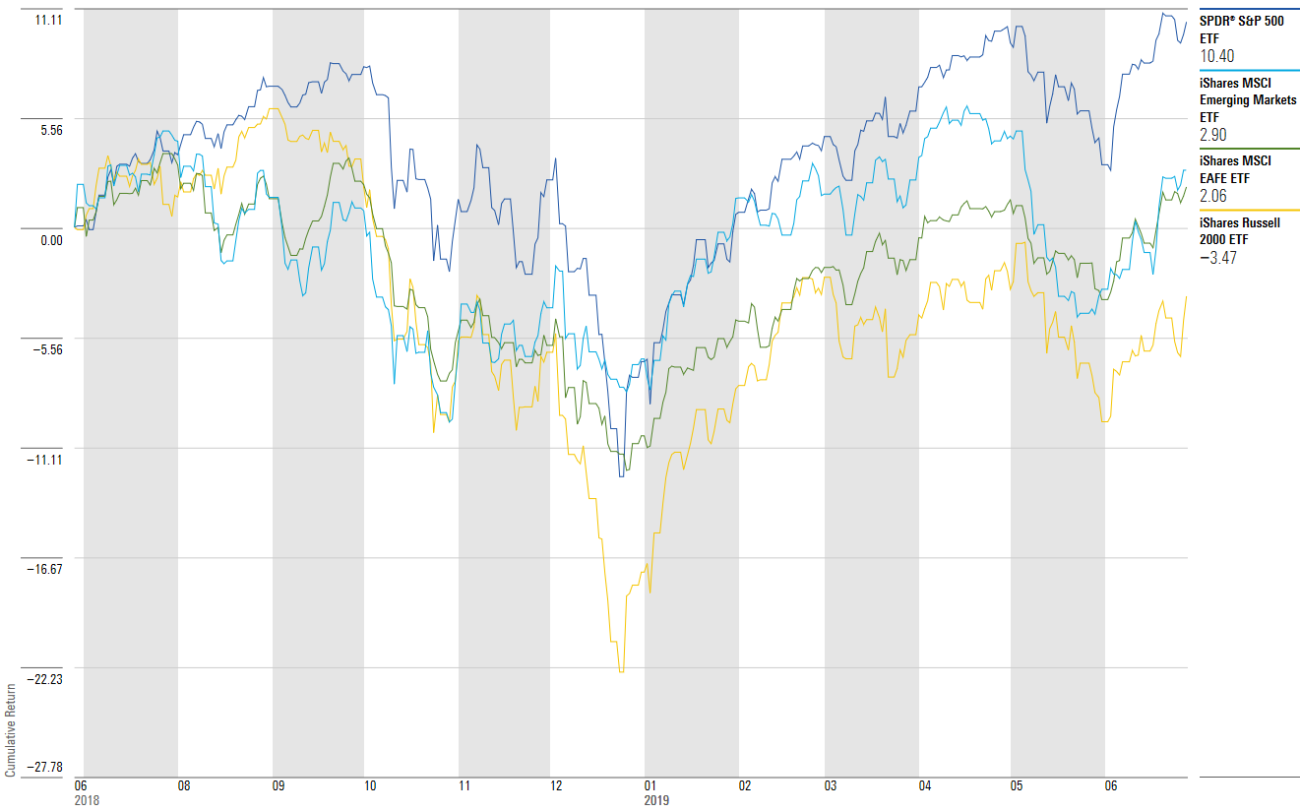

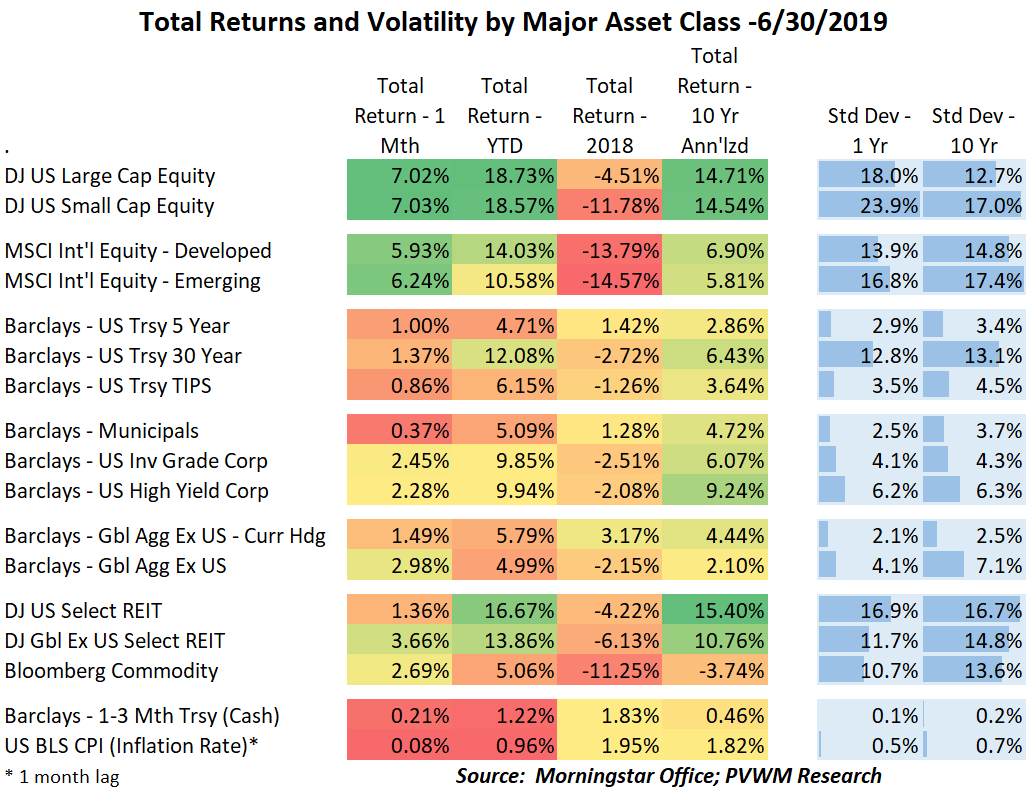

I occasionally say that to people throughout the year just to get their attention. I mention it here as a reminder of the relative market lows from late last year, with the trough occurring on Christmas Eve. The market had a strong run since then, but don’t forget this low base for YTD numbers in the table at the bottom.

The main drivers were again trade negotiations and expectations of an easing Fed.

Recall May was a very rough month for equities as trade negotiations with China stalled and additional tariffs were threatened against Mexico. However, Mexico took action to avoid new tariffs early in June which caused a snapback in equities. Chinese trade concerns did not go away during the month, though seeing a favorable reaction on July 1 after the G20 meeting. The market seemed to believe any negative implications would be offset by the Fed providing any stimulus needed with lower rates.

The end result: if you switch the sign from the negative May equity returns you end up with June returns. This brings the YTD levels back to the lofty returns seen at the end of April for both US and international equities. Within the US markets, large and small caps had similar returns. At the sector level, Materials rebounded nicely on trade chatter, followed by Technology and Energy – yes Energy – though that sector is still down for the quarter.

The bond market also continues to perform strongly. The YTD returns in the table at the bottom are normally associated with a full, very strong year. The 30-year treasury kept going like the Energizer Bunny , topping 12% YTD. Also notice investment grade credit has a YTD return just shy of 10%. High yield stabilized in June after a rough May, but only in line with high quality bonds leaving YTD returns similar. On the commodity front, energy and gold had a very strong month.

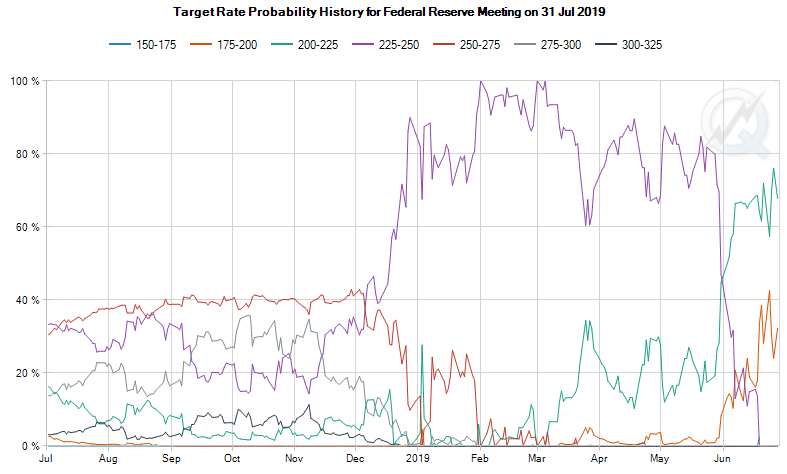

The Federal Reserve’s FOMC meeting on June 19th was watched closely. The “Summary of Economic Projections” showed improving expectations for real GDP and lowering unemployment rate. However the expected inflation levels were reduced for the next two years. This along with meeting minutes that noted “uncertainties about this outlook have increased” caused eight FOMC participants to shift their view to lower rates by the end of year. However, nine participants do not see a need for lower rates (not all 17 are voting members). Using the CME Group FEDWATCH TOOL, the market is pricing in at least a 0.25% rate cut at the July 31st meeting with 100% certainty and even a 0.50% cut with a 20% probability (was over 40% a week ago). It will be interesting to see if the market backs off after the latest G20 meeting and the upcoming jobs report on Friday July 5th. Below are the implied probabilities over time for the July meeting. I’m glad Chair Powell has press conferences after each FOMC meeting!

Have a Happy 4th.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com