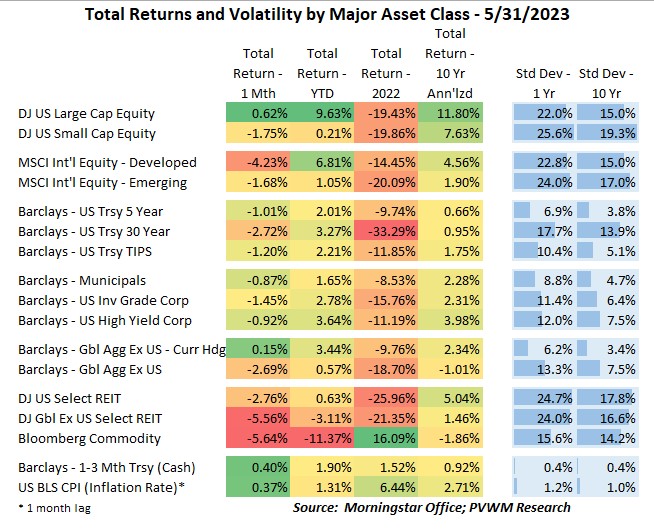

Asset Class Returns - 5/31/2023

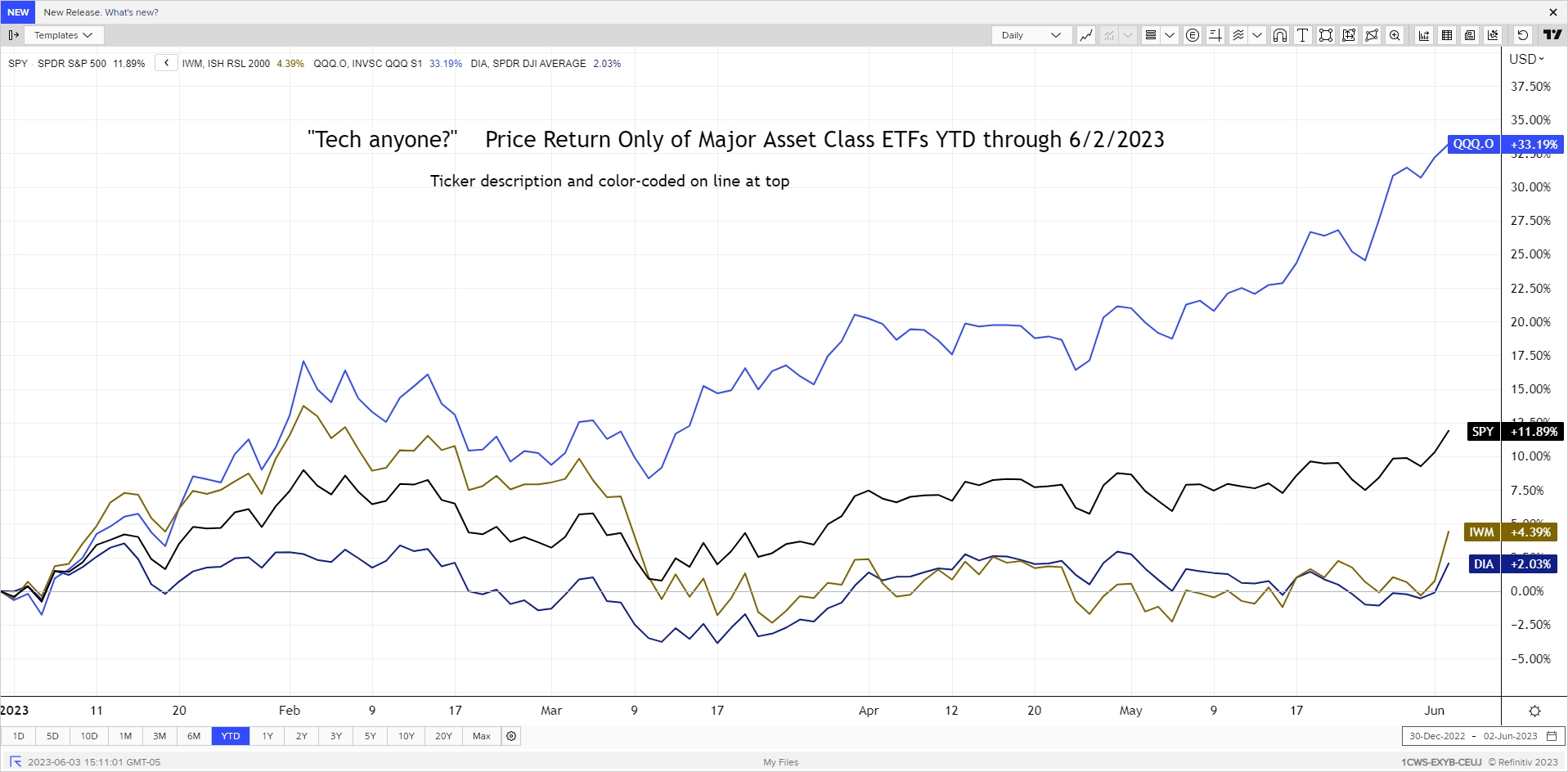

The “1 Month” column in the table above has an interesting mix of returns this month. Starting with bonds, they were down slightly for the month across maturities and underlying credit (Muni, Corp, High Yield). But if you glance to the bottom of the table, you will see the newest addition to bond asset classes for some – CASH – returning 0.40% for the month – or 4.9% if annualized! Commodities got crushed on lower energy returns (though watch the OPEC+ meeting this weekend). On the equity side, there is close to a 5% range in monthly returns as US large caps continue to lead the charge. Surprisingly, the laggard for the month had the highest YTD return last month - international developed markets. US small caps and international emerging continue to meander together. If one drilled into two US large cap indices, you would even find close to an 11% range in returns. In May the tech-heavy NASDAQ (QQQ) returned 7.7% while Dow Jones Industrial Average (DIA) was down -3.2%. The graph below shows this range on a YTD basis, along with S&P500 (SPY) and Russell 2000 (IWM). If you added a “growth ETF” it would track the Nasdaq and a “value ETF” would track the Dow Jones Industrial Average. That will explain most performance divergence across investors.

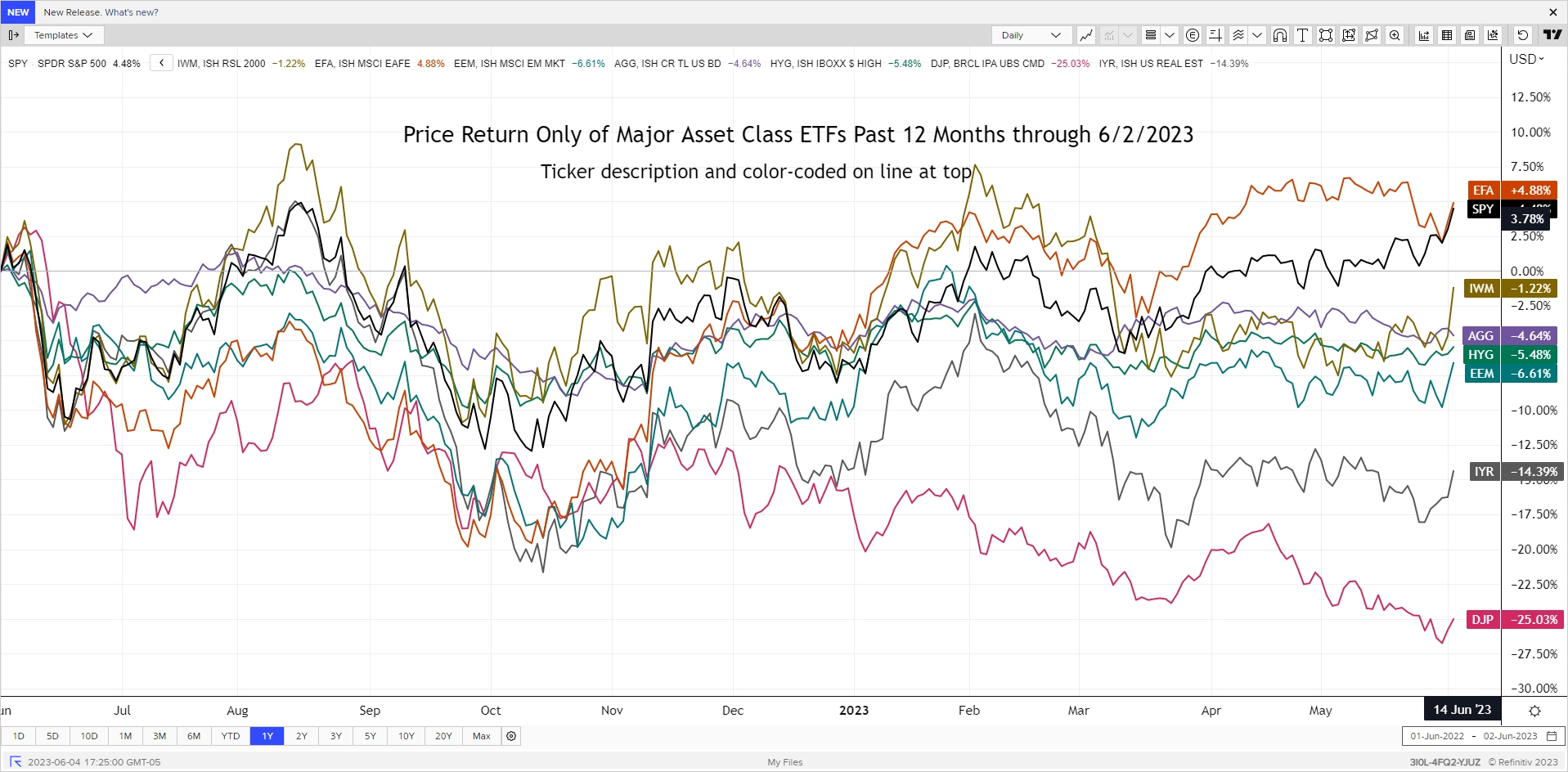

The graph below shows price return only of major asset class ETFs. Note this graph covers the past 12 months so different return for SPY and IWM from the first graph. Also note this includes data through 6/2/23 so it reflects the sharp rally after the jobs report and debt ceiling resolution. The recent outperformance of Int’l equity reversed and now the past 12-month price returns are similar to US Large Caps. The US Dollar strengthened in May which reduces international returns after converting to US$ terms. Commodities continue to lag, both from potential recession concerns but also depleting stockpiles according to Goldman Sachs commodity strategist. There is an OPEC+ meeting in early June that may reverse the trend.

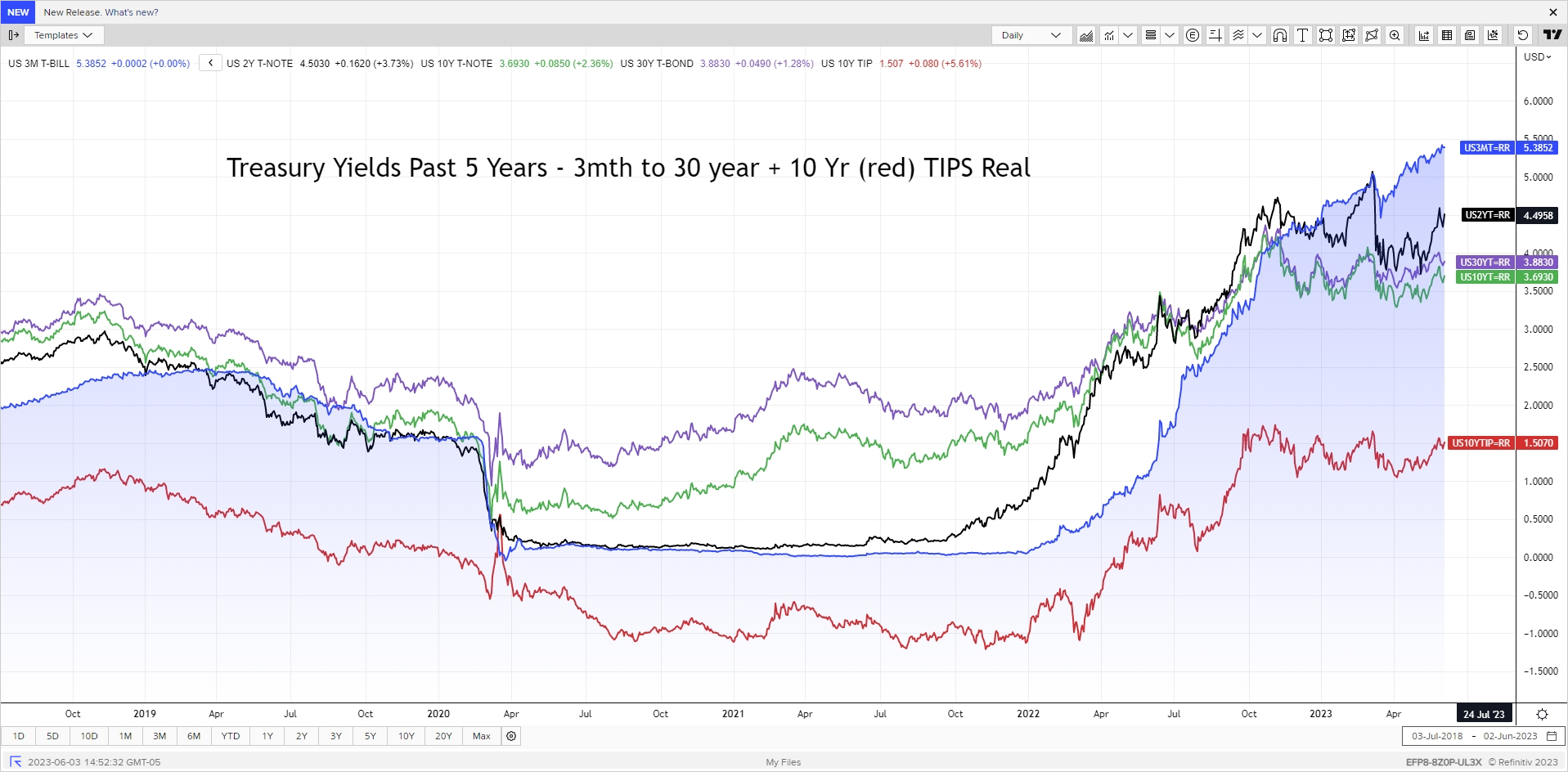

The usual Rates graph shows the continued march higher, especially at the shorter-end. The 2-year treasury rate is back to 4.5% after collapsing mid-March around the banking issues. The 3-month treasury bill remains at the top of the rate mountain at close to 5.4%. The crazy moves around the 1-month T-Bill have settled down after the debt ceiling issue has been resolved though watch the extremely large Treasury Bill issuance next week following the debt ceiling resolution. The 10- and 30-year rates still seem too low to me but the market is pricing in a successful inflation-fighting campaign and lower rates after a recession hits. We don’t talk about the real yields of TIPS often, but a 10-year real yield in the 1.50% range appears attractive (red line).

The next Fed meeting concludes June 14th. In addition to the usual statement and press conference, this meeting also provides the Fed’s “Summary of Economic Projections” on GDP, unemployment, inflation and Fed Funds rates (the dot plot). The current Fed Funds target range is 5.00% to 5.25%. For most of May the market expected the Fed to pause at this upcoming meeting. But the Fed’s preferred inflation gauge – Personal Consumer Expenditures – ran hotter than expected on May 26th. Fed Funds futures began pricing in over a 60% probability of a 0.25% hike. This was abruptly “talked out of the market” by a couple Fed speakers indicating it may be prudent to pause this meeting and allow previous cuts to work through the system before possibly raising later if necessary. “Skip” was the word tossed around. The graph below shows the implied probability of raising rates by 0.25% at the next meeting. You can see the spike up on May 26th followed by the walk-back – though still hovering over 20% probability. It will be an interesting meeting coming up. (Source: CME FedWatch Tool).

To the recent graduates out there – congrats! Go confidently. Go thoughtfully. But GO! … and remember to call your Mother!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com