Asset Class Returns - 5/31/2021

Here is this month’s market summary. Unless noted, the time frame is year-to-date ending 6/1/2021.

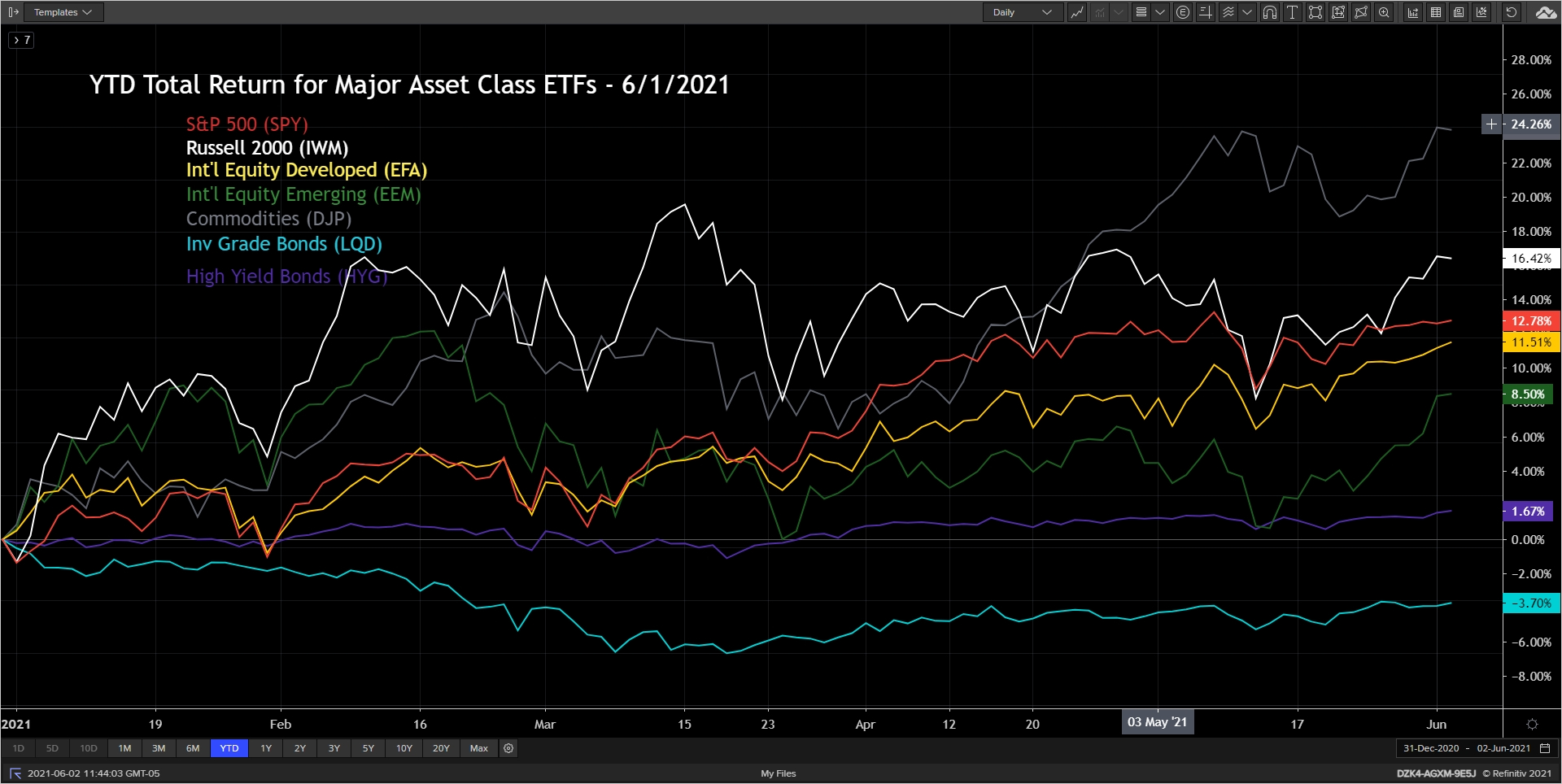

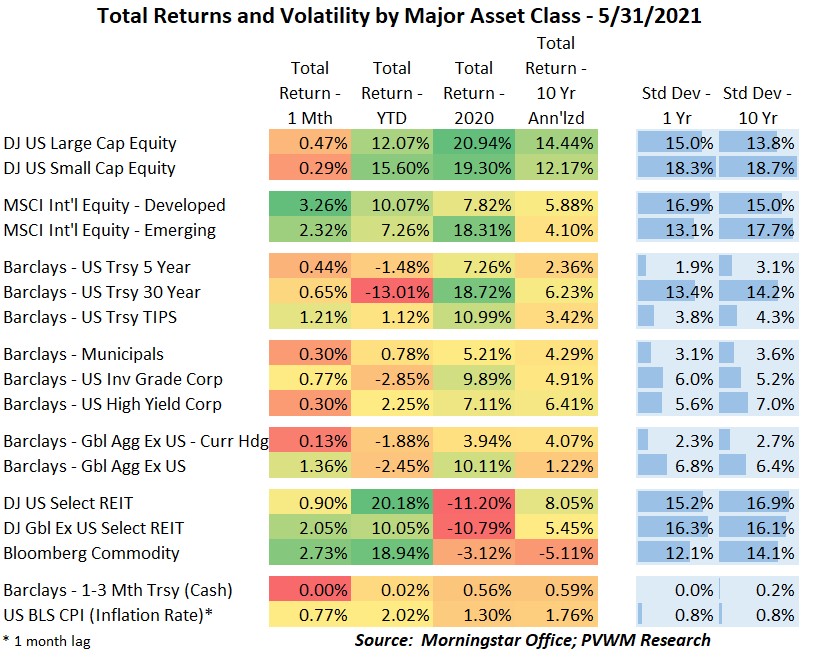

We will start with the major asset classes. The slow flat-to-upward trend continued in most markets but small-caps, emerging markets and commodities experienced a dip mid-month before recovering strongly.

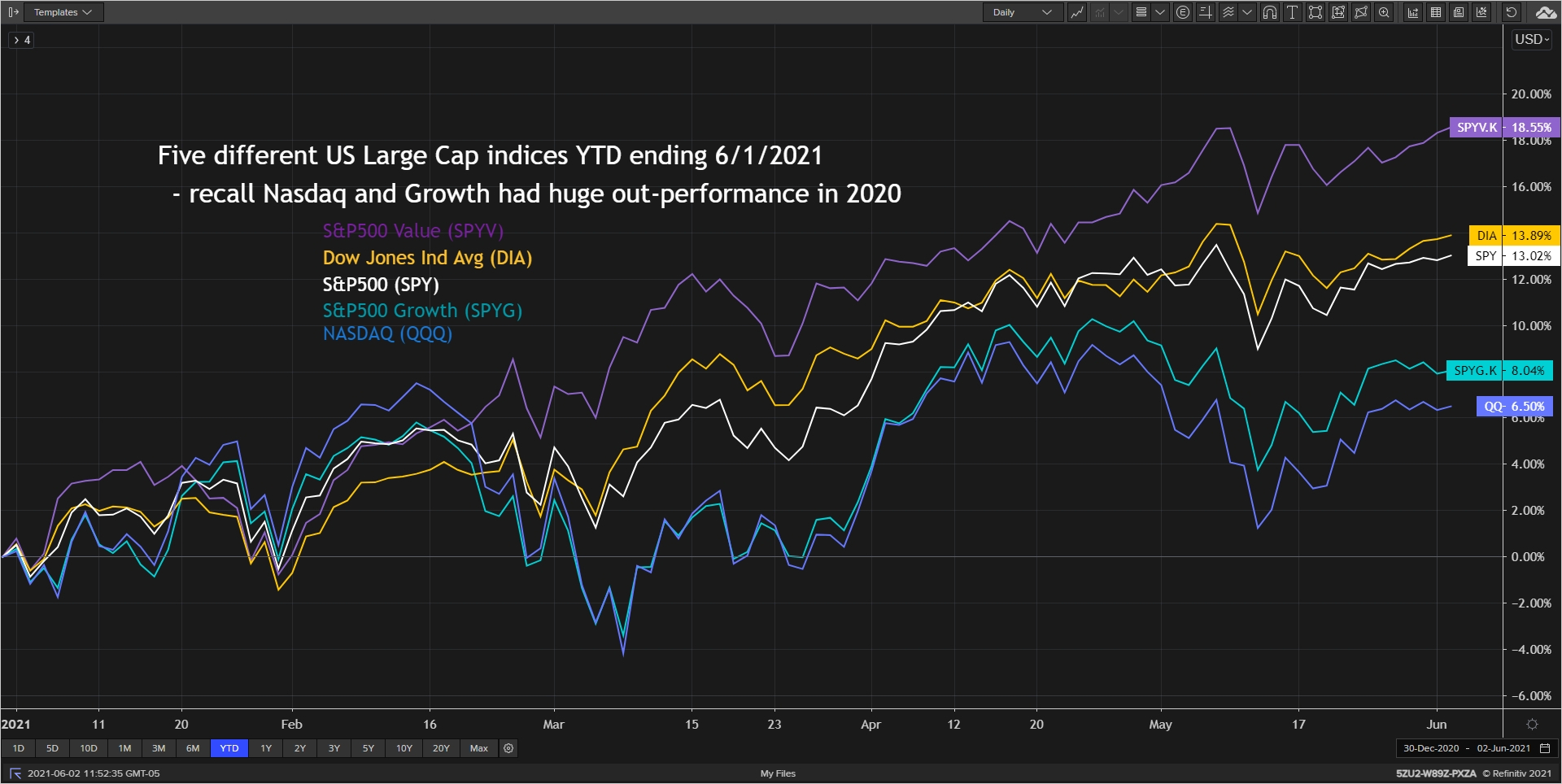

Within the US large caps (think S&P500 or DJIA), Growth and Tech pulled back significantly early in the month but bounced back, though down slightly for the month. Value saw a delayed pullback though not as deep and ended the month higher, widening the outperformance of Value YTD to more than double.

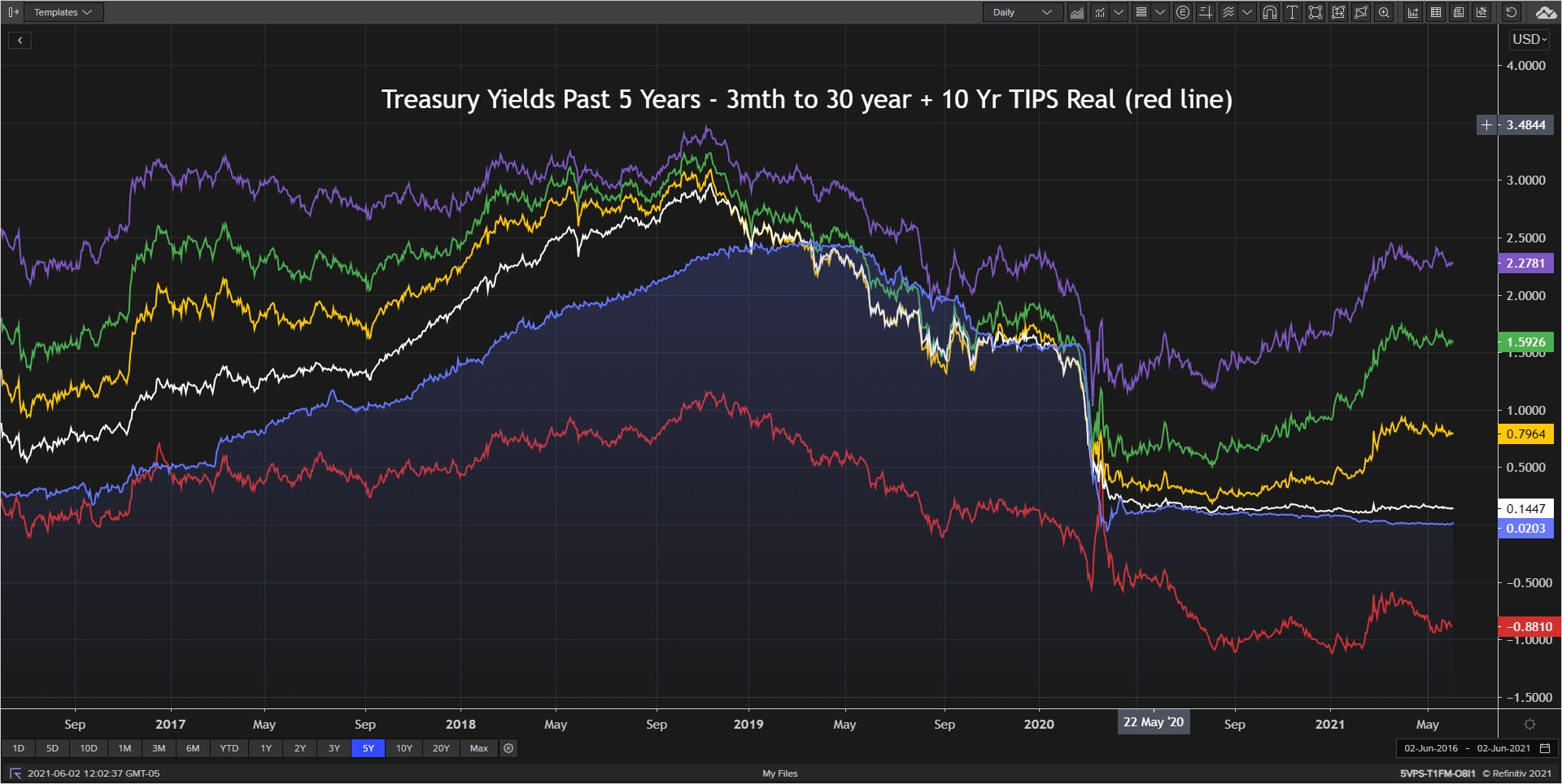

Treasury yields (nominal) have been flat to down slightly for the last couple months after a large move higher during the first three months of the year. Real yields in the TIPS market have fallen even more than nominals, pushing up the breakeven inflation levels. The Fed keeps buying bonds which is offsetting the lack of demand in the market. When the Fed starts to think about thinking about tapering the march higher may continue. A weak jobs report in early May kept real yields down – for now.

Enjoy the start of summer.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com