Asset Class Returns - 4/30/2022

Here is this month’s market summary. Unless noted, the time frame is year-to-date with screen shots through 5/2/2022.

Wow!

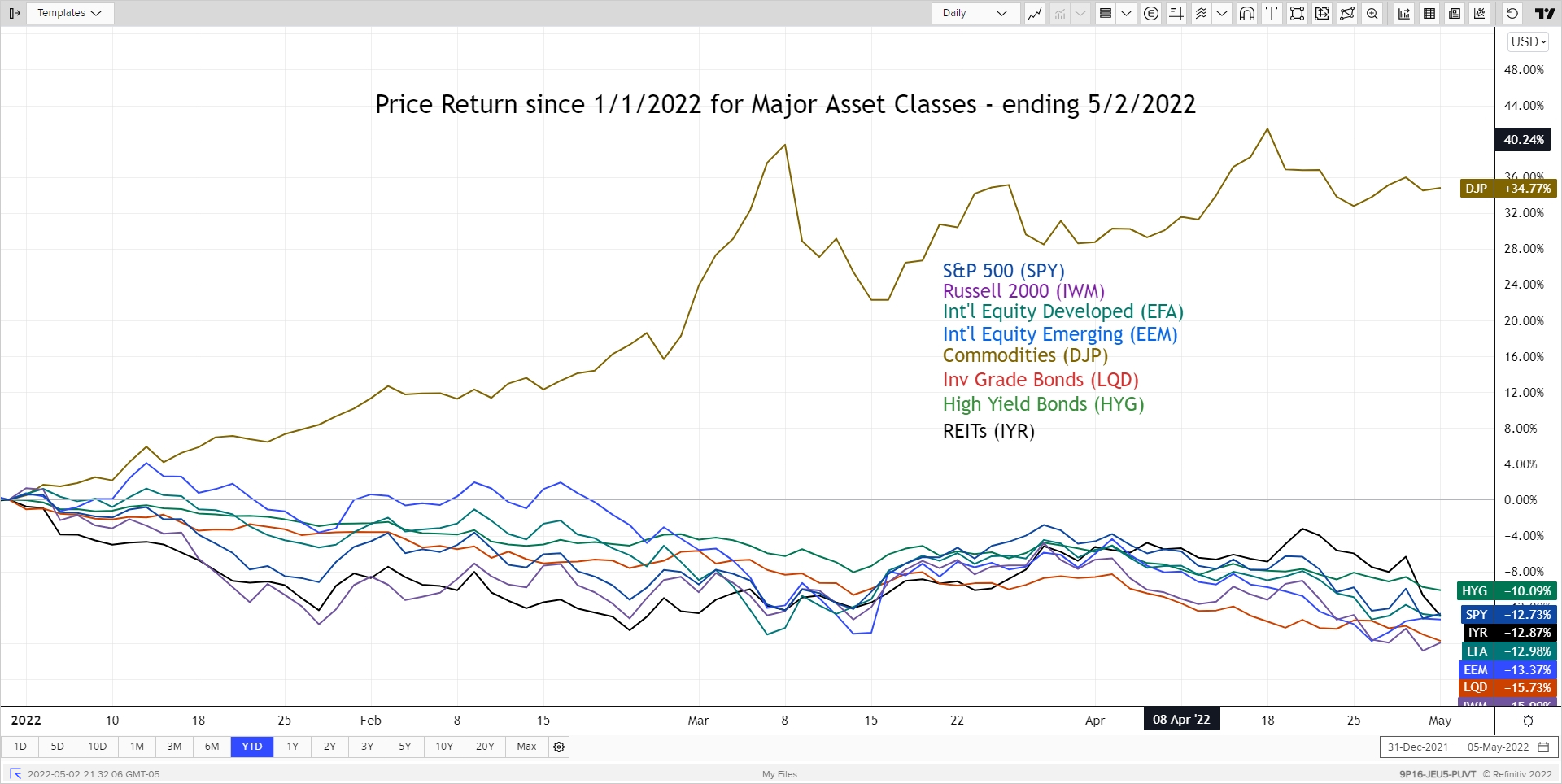

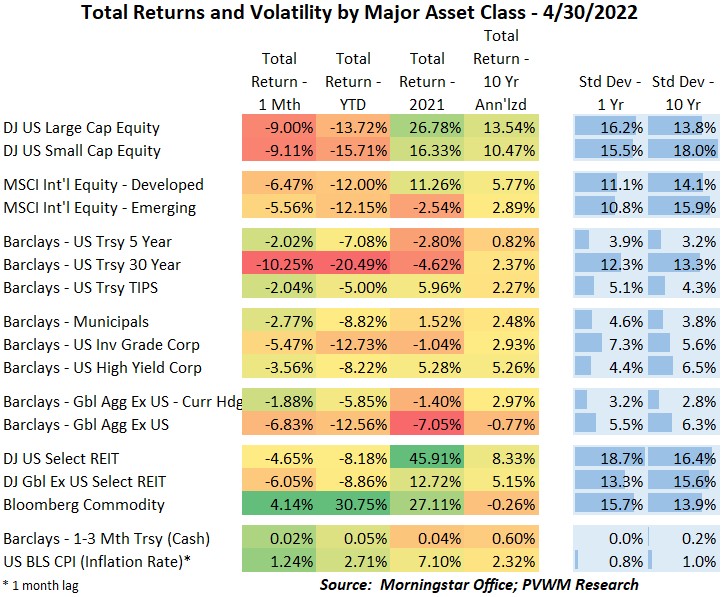

Last month I included more graphs on rates given the large move in bond markets. Looking at the table at the bottom of this blog post, you will see both equities and rates had a pretty nasty month. Let’s dig into both. The only positive return – commodities – again.

I shifted the major asset class graph to YTD. I was tempted to exclude commodities for a more refined graphing but it provides the proper context. The YTD returns for most equities are bunching up in the -13% area. US Small Caps did slightly worse but a popular investment-grade bond ETF (LQD) was also down over 15%. Most of that fund’s move is due to treasury rate moves over credit spreads – more on that later. REITs were also hit pretty hard, especially the last few days of the month. The combination of continued higher rates and concerns by some of a recession finally caught up with them.

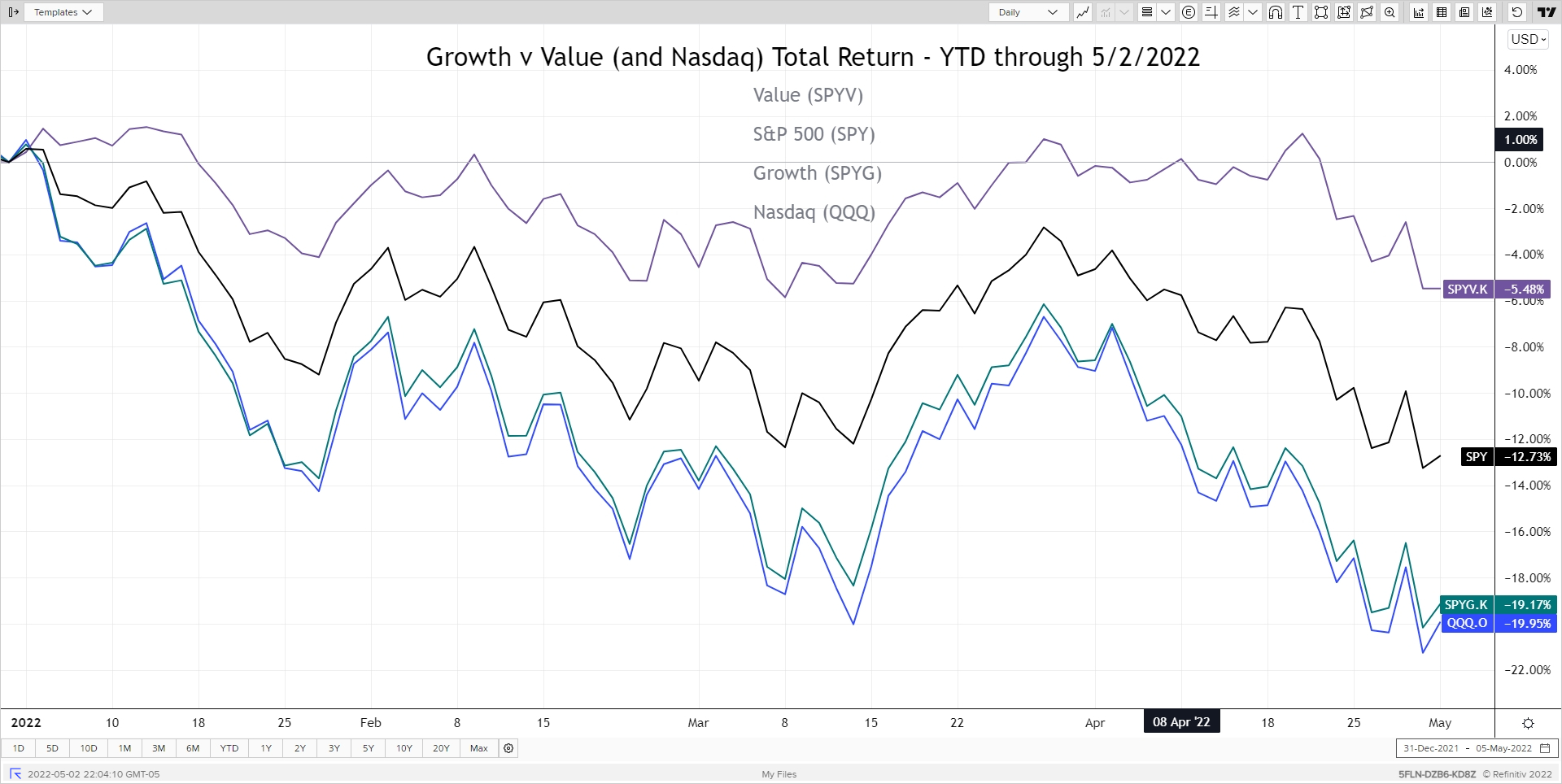

Given the large swing in growth stocks this month, I am including the Growth vs. Value chart. I also added the Nasdaq ETF (QQQ) to show how closely that captures the Growth component of the S&P500, which is dominated by large cap tech stocks. The 15% dispersion in YTD returns between Growth and Value is noticeable in a portfolio depending on how one is positioned.

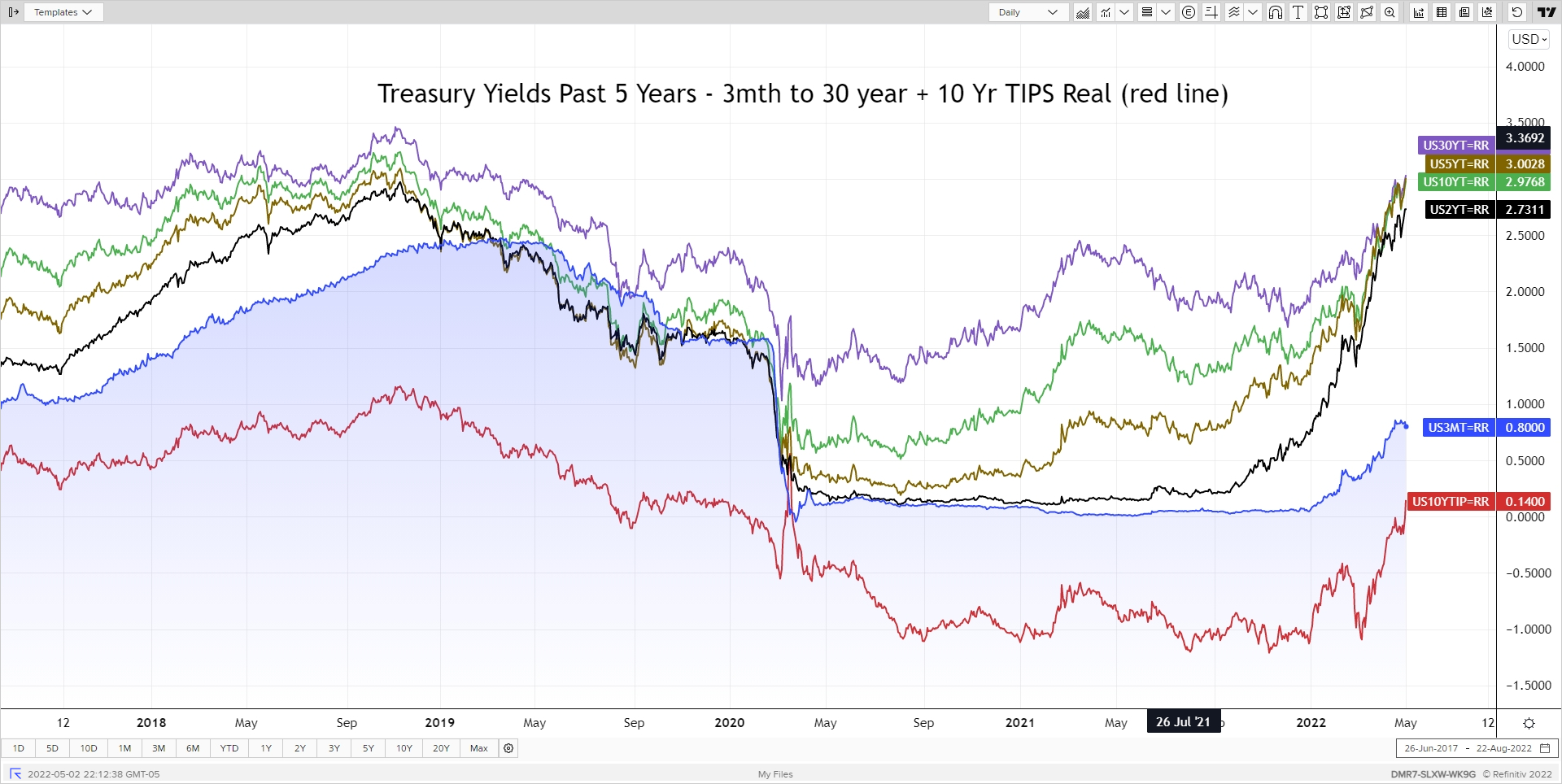

Here is the usual Treasury rate graph – same as last time except rates continue to march higher. There are two things that jumped out at me this month driven by the active Fed (I guess three if you count the 10-year hitting 3% intraday yesterday).

- 10-year real yields – the rate earned on a TIP excluding the inflation component – is now positive again. This higher rate discounts equity cash flows making them worth less – especially Growth.

- The good old 3-month Treasury Bill is yielding 0.80%. And there is more love to come there as the Fed keeps raising rates.

I will spare you the graph of mortgage rates, but they are up also.

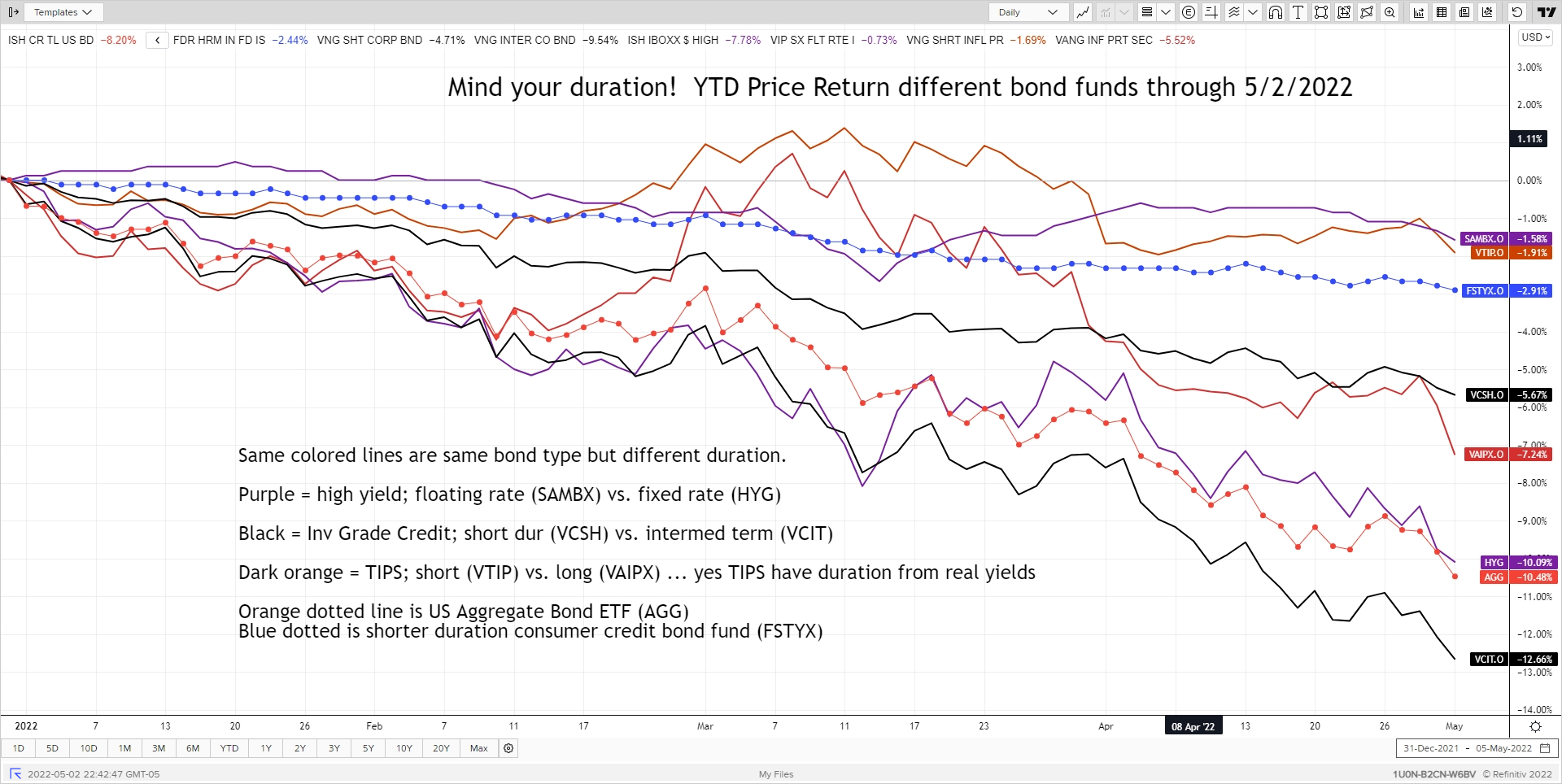

Given the continued large move in treasury rates and the relative tame moves in credits spreads (the extra yield paid to take credit risk), the graph below shows the different returns on bond funds in similar underlying asset classes (captured by same line color) but of different duration. For example, the black lines are two corporate bond ETFs, one short duration and one intermediate. Another example is the two purple lines, one for floating rate HY bank loans and the other for fixed rate HY bonds. In addition to demonstrating the impact of duration on returns, it also shows there has not been a large credit spread widening on lower quality bonds - yet. You can see the biggest negative returns come from investment grade credit with longer duration.

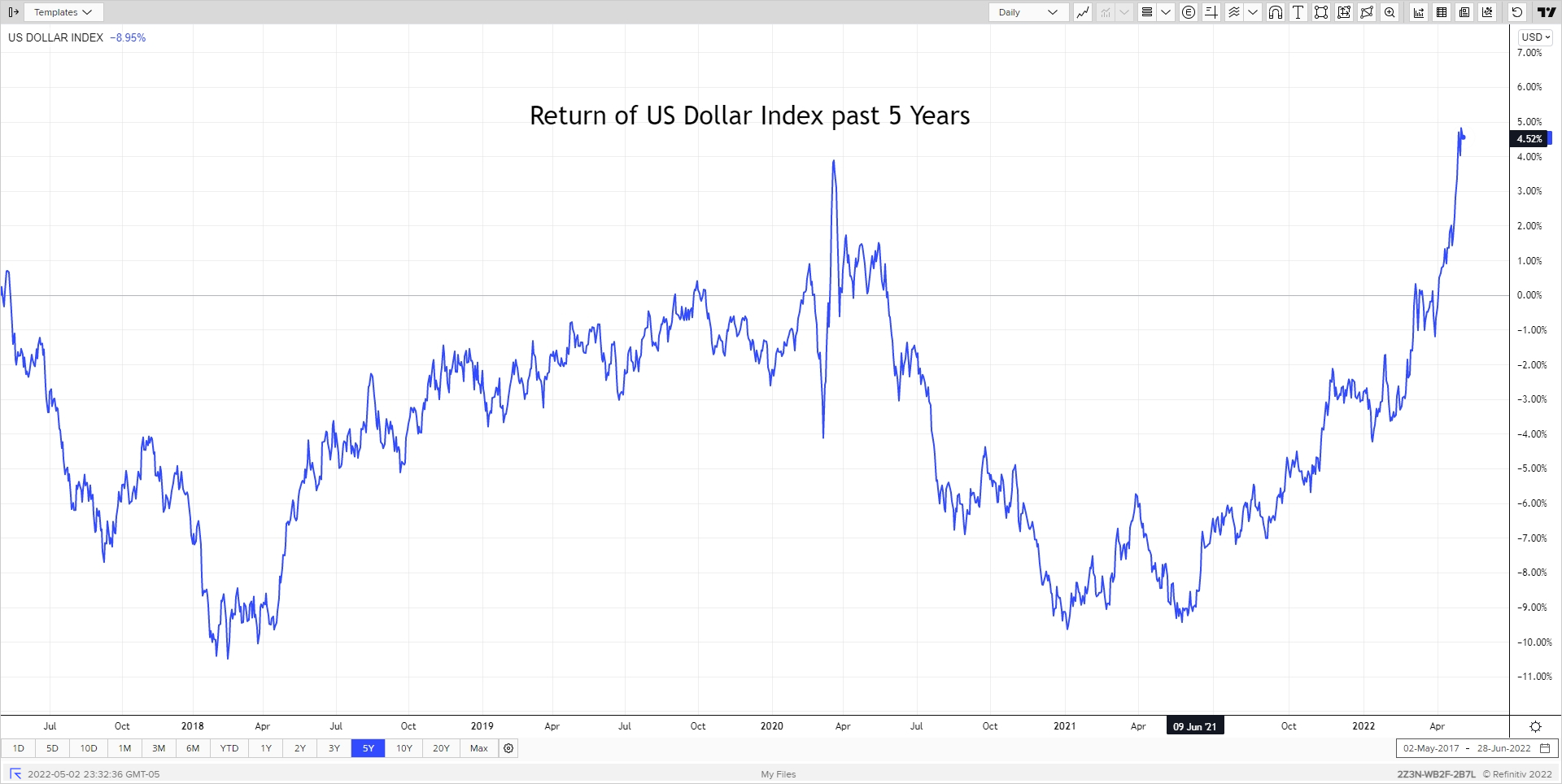

I haven’t mentioned this in awhile but want to draw your attention to the recent strength in the US Dollar. There are many drivers of USD currency value but bear in mind it is expressed relative to another currency. One key driver of relative value is the short-term interest rates of two countries. The Fed is expected to raise rates faster than most other countries, making our higher rates more attractive, thus driving up the currency as outside investors have to convert their currency to the USD (buying demand drives up price) to invest in our paper (or bits). The USD has increased about 8% for 2022 alone. This causes international investments to have a lower return by a similar amount since international investments are converted back to USD to show portfolio returns. This can be seen in the table at the bottom of this post by comparing the Barclays – Global Agg Ex-US bond index, one with and other without a currency hedge. YTD return difference – about 6.75%.

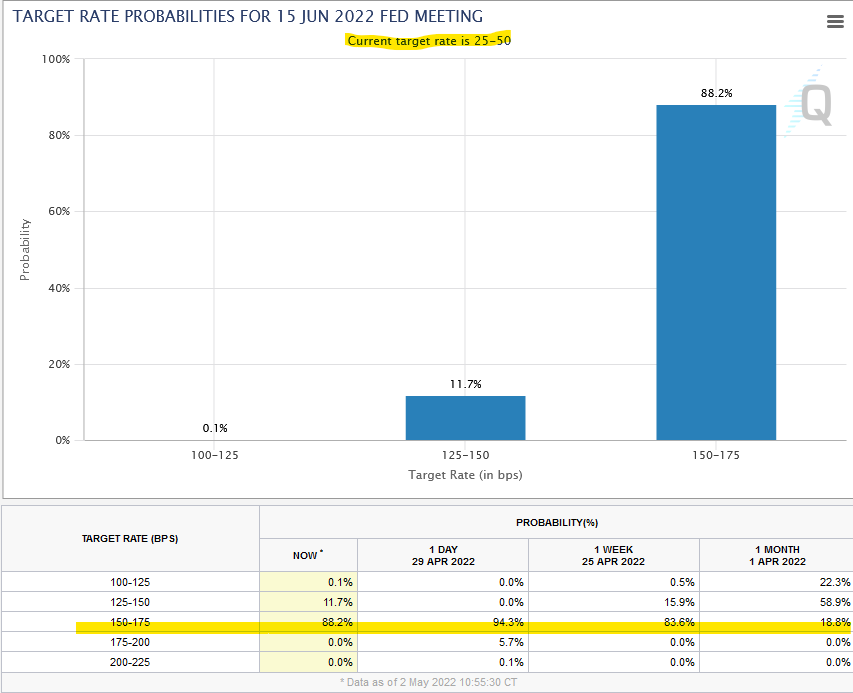

Finally, this Wednesday, May 4th is the conclusion of the next FOMC meeting. The Fed Funds futures are pricing in a near certain 0.50% rate hike. But what surprised me this month was the market pricing in a very high probability of a 0.75% hike at the June 15th meeting (Source: CME FedWatch – 5/2/2022). The Fed has stated they want to front-load tightening to catch up with inflation (too late to get ahead of it). Also recall details of the balance sheet reduction will be announced on 5/4. That has similar impacts of rate hikes and my belief is the Fed may stick with 0.50% hikes but an aggressive balance sheet unwind. Regardless of the path taken, will the Fed be able to tame inflation without a recession? Not likely, but also not an imminent threat.

May is here. Happy Mother’s Day to all Mothers out there and “Congraduation” to the bright young minds on your milestone.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com