Asset Class Returns - 4/30/2021

This month’s monthly summary will let graphs do most of the talking. Unless noted, the time frame is last six months ending 5/4/2021 to capture a few days before the first COVID vaccine was announced.

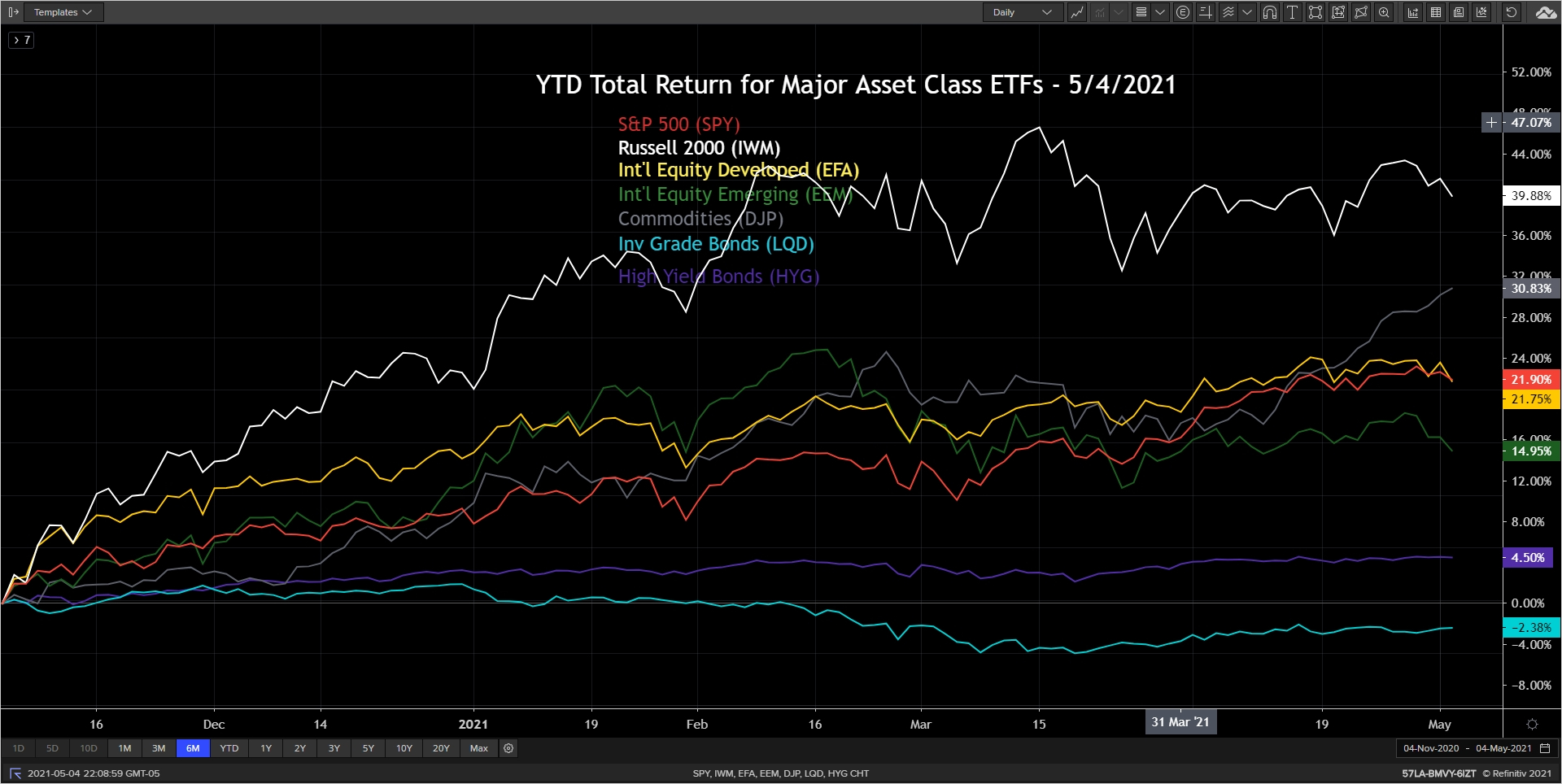

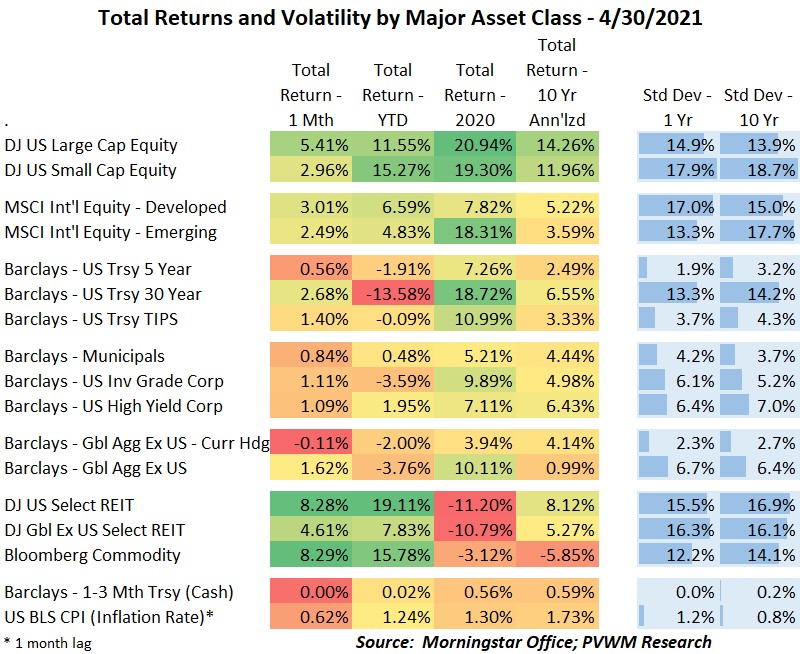

We will start with the major asset classes. Most markets have settled in the last couple months with a drift upwards.

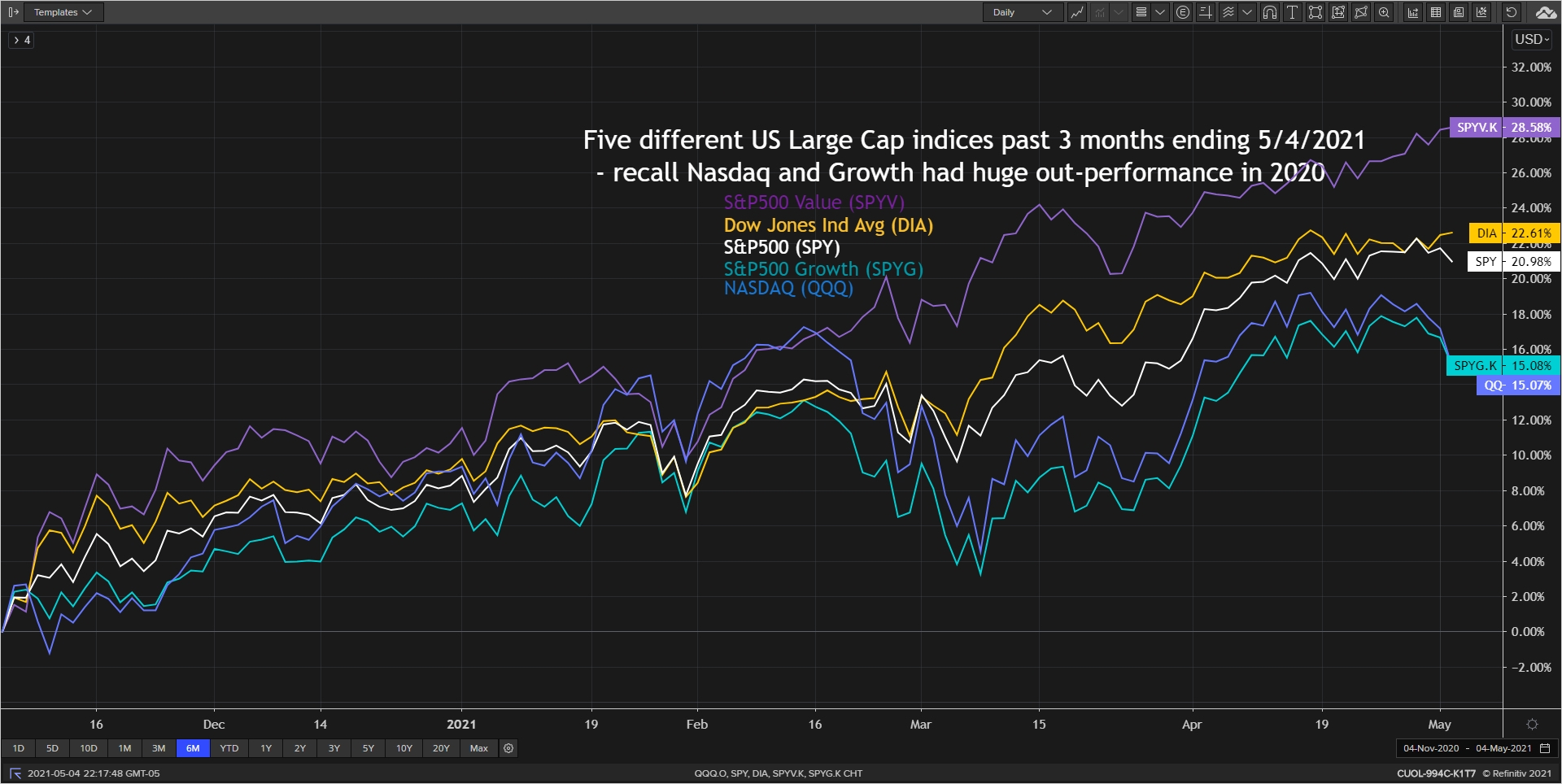

How is that large cap index dispersion looking? After a mid-month rally, Growth and Tech cooled while Value chugged higher.

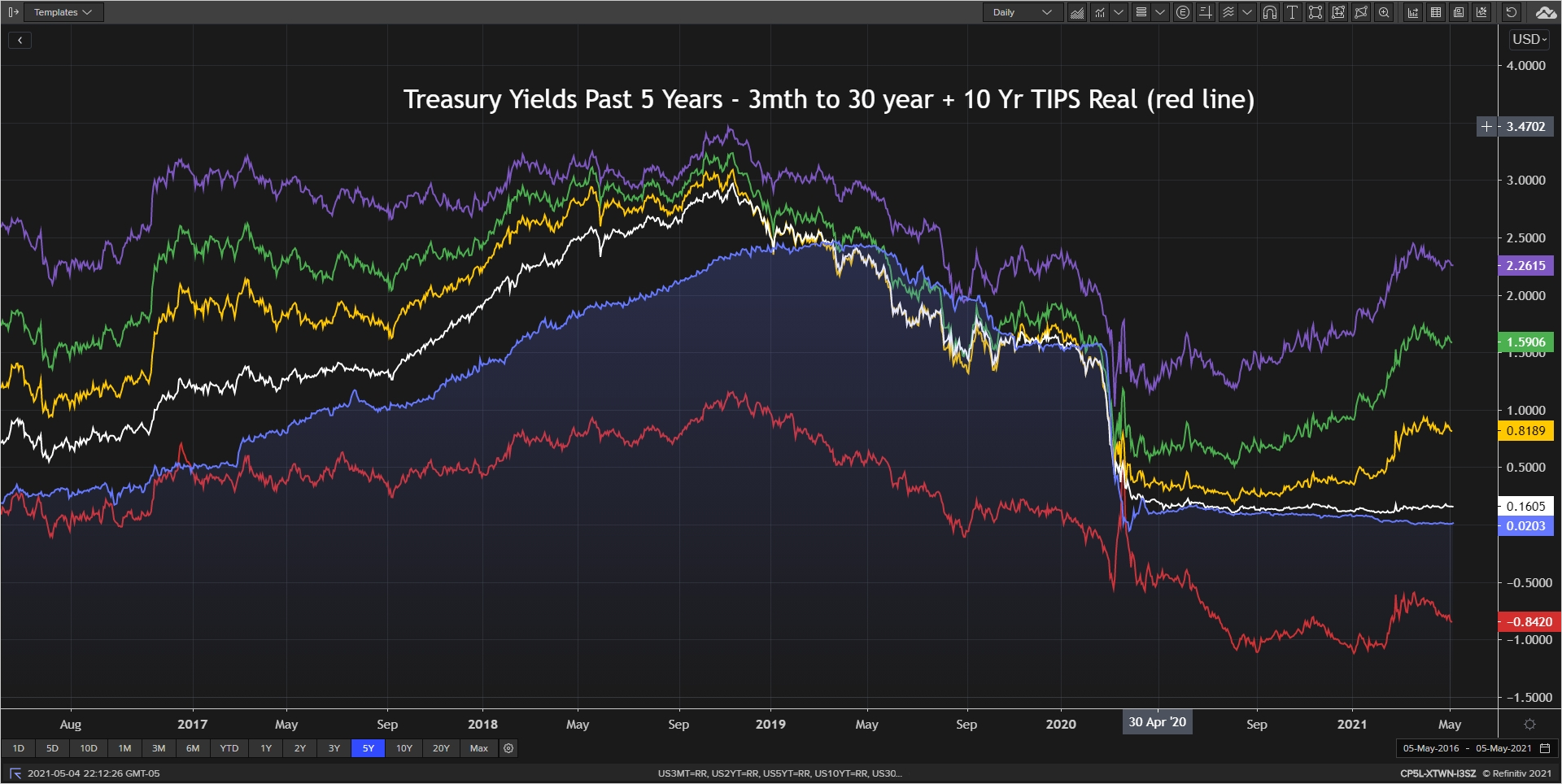

Fed Chair Powell said the FOMC will wait for the data to show heat before taking action. The bond market seems to like it – until it doesn’t.

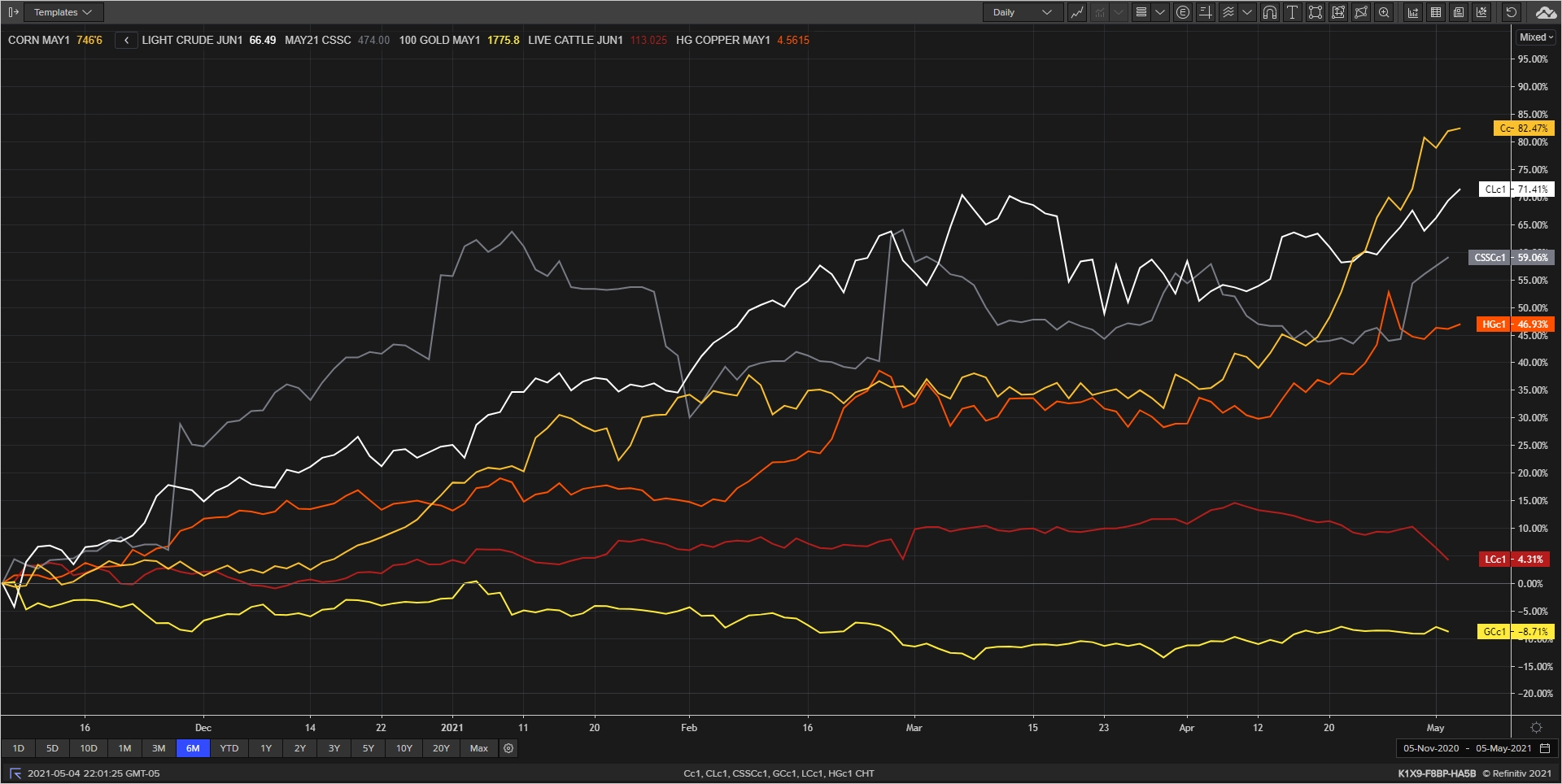

Commodities led the month’s return column. Most people think of energy and gold, but don’t forget grains and industrial metals. Corn has popped and gold lost its luster. Steel is solid.

When looking at economic data it is good to expand the time horizon. Here is unemployment rate over past 10 years. This Friday’s jobs report could print below 6% - a very speedy recovery that still has legs.

Until next month.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com