Asset Class Returns - 3/31/2021

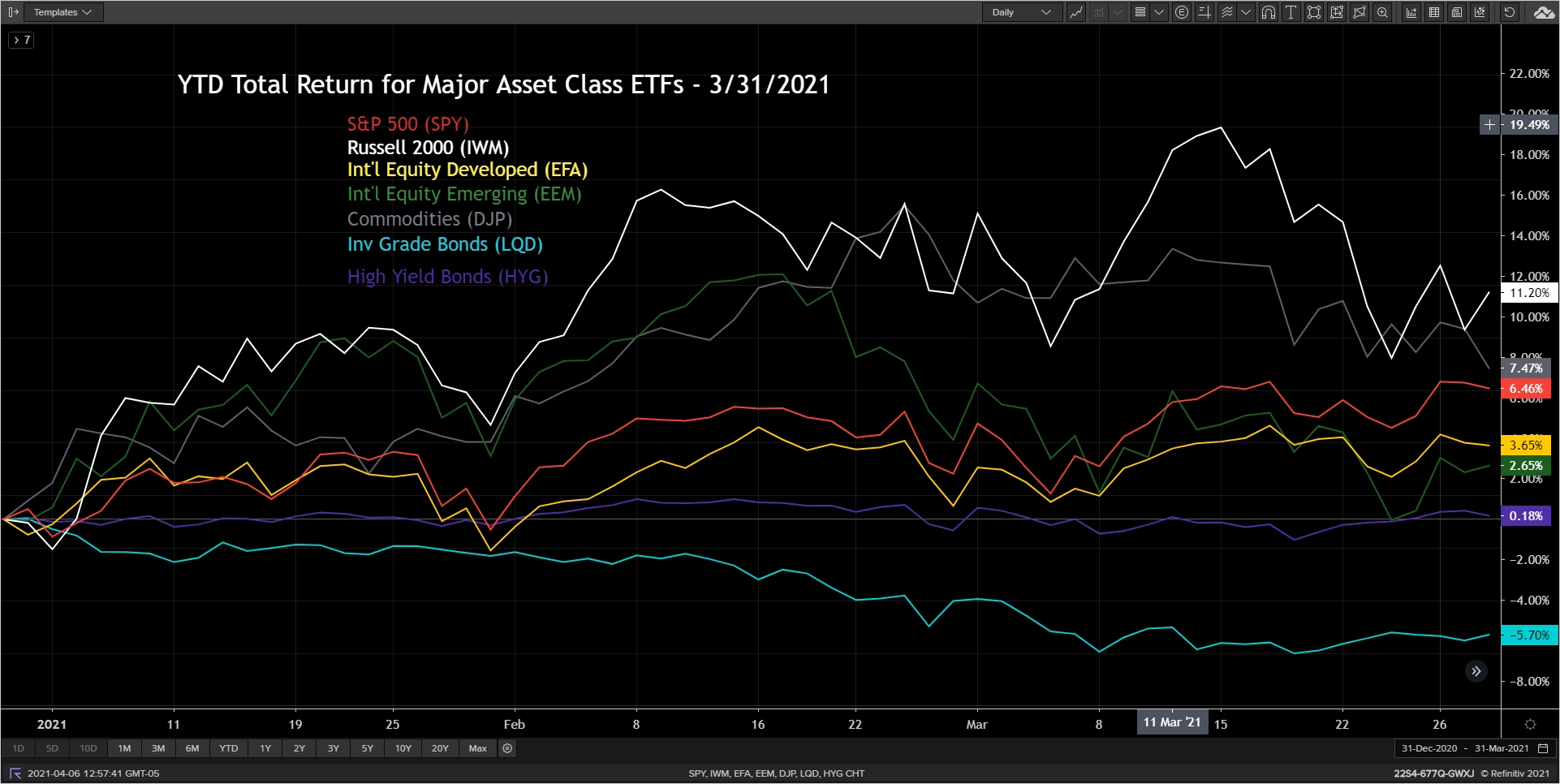

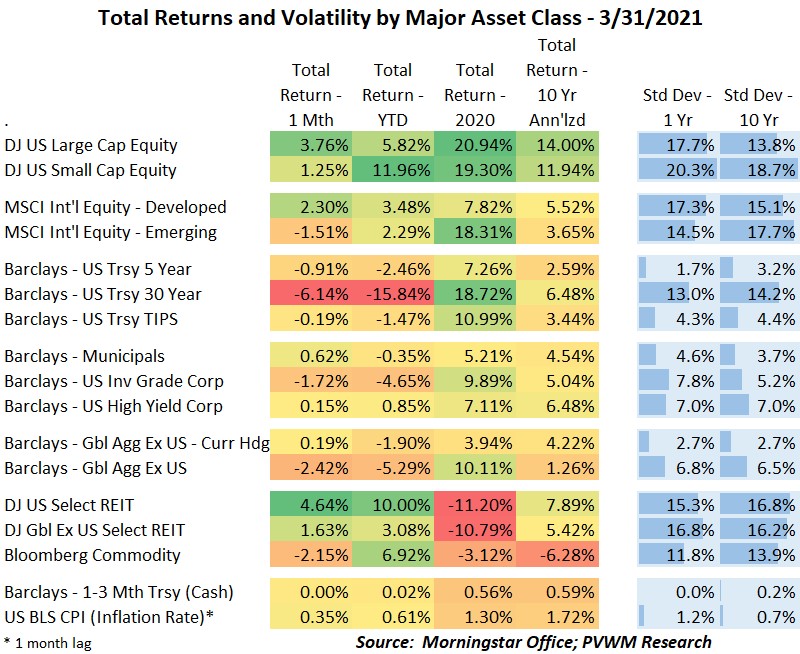

Year-to-date equity returns are very solid for US markets but less so, though still positive, for international. US Small Caps remain at the top of the pile but pulled back after a very strong mid-month rally – a continuation from early February. During past years the lagging asset class was commodities but this year it is the corporate bond market (mainly driven by underlying treasuries – see later). The high yield market is surprisingly flat on the year as credit spreads have tightened to offset rising treasury rates. What about those normally lagging commodities? Up a nice 7+% on the year.

Here is a quick update on Growth vs. Value – or the more refined may look at cyclicals vs. non-cyclicals. Value has underperformed Growth for many years. Since the COVID vaccine announcements in November 2020, Value has been outperforming. Two sectors leading the charge are Energy and Financials. How much more can it go? If you expand the relative performance out to the past two years, one could argue there is more ground to recover in a growing economy.

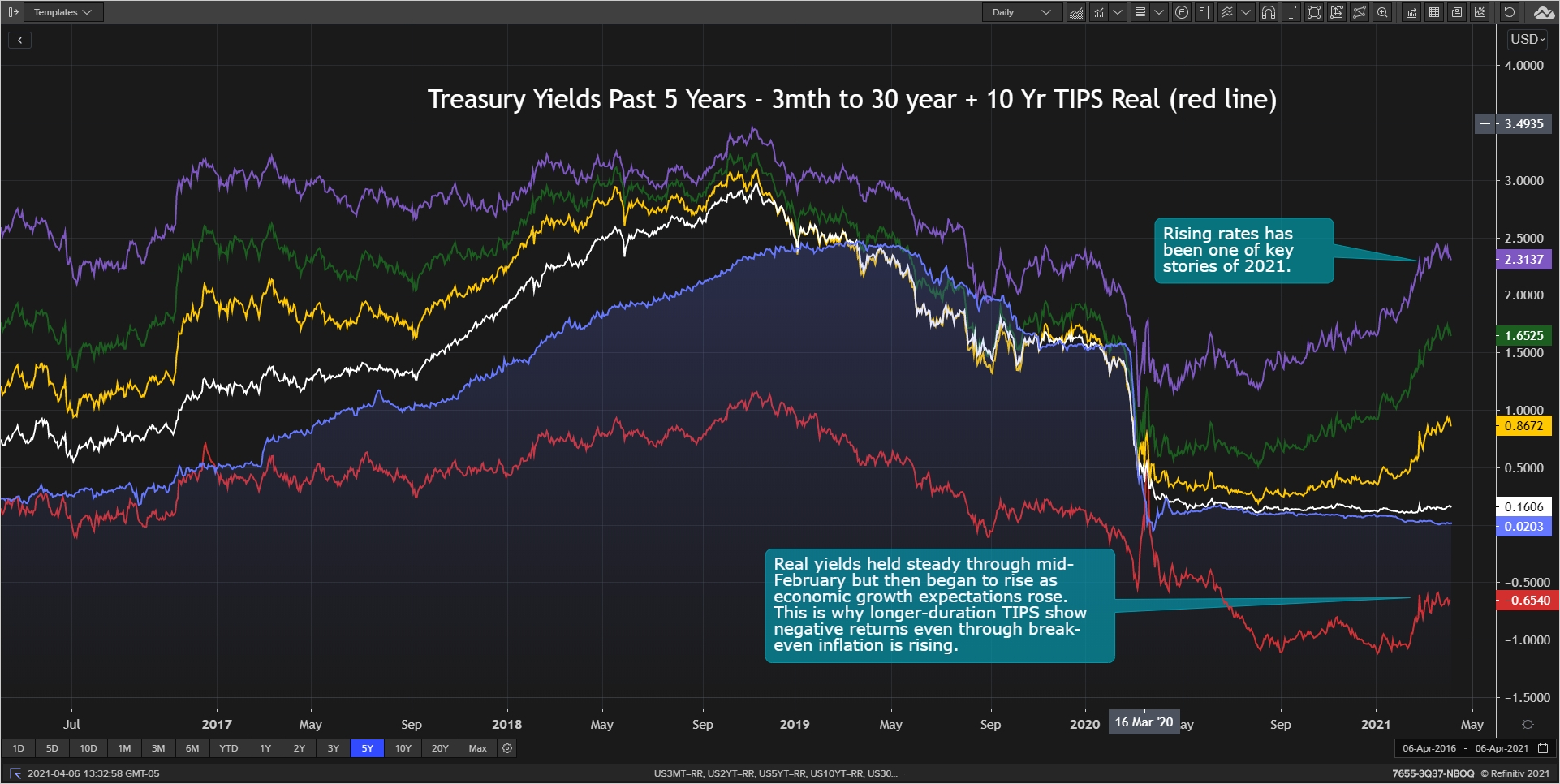

One of the key stories of 2021 has been the rising rates. I have mentioned this in the past monthly blog posts but it is important to discuss again. As a reminder, the Fed plans to keep rates low until inflation consistently runs above 2%. But this is the short maturity bond yields (2 year – white; 3 month – blue lines) below. Longer maturity bonds tied to mortgages, corporate debt and municipal debt have been rising substantially (30 year – purple; 10 year – green lines). What is that red negative line you ask? The real yield of 10 year TIPS. Inflation may be coming but if accompanied by real economic growth, the real yield may have more room to rise. Note that TIPS bonds also have a duration (price sensitivity) driven off this real yield. You will see in the table below the difference in YTD returns for 5-year vs. 30-year treasuries. Yes, that number is correct – the long bond treasury index is down over 15% YTD.

That’s about all the March Madness I can think of. And if you want to emulate the Baylor Bears approach, stay aggressive but do it smartly and follow your game plan.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com