Asset Class Returns - 3/31/2019

… they go out like a bull.

For the readers of my February 28 asset class summary, you may recall my play on the old adage of March coming in like a lion and going out like a lamb. But there was no change in the direction of broad equity markets for the month of March, though small caps were weak.

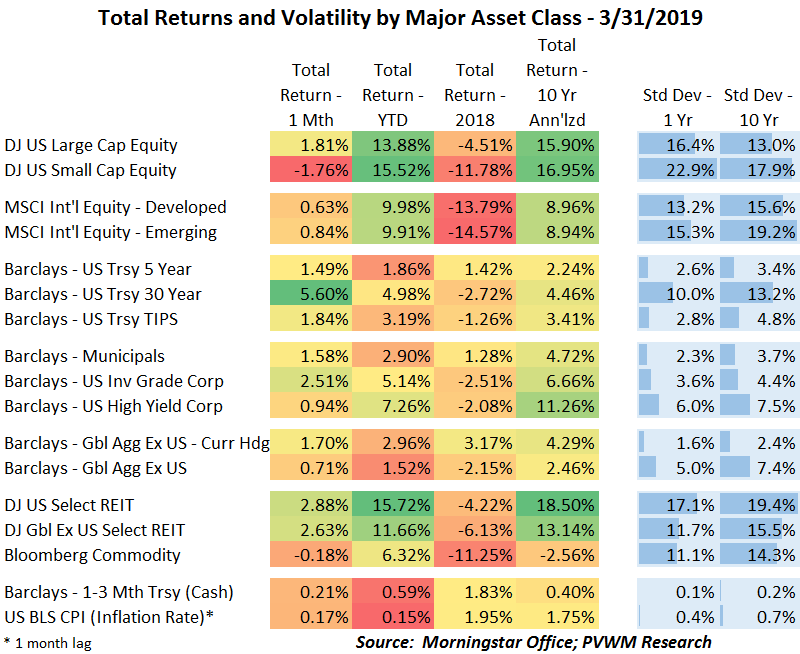

I normally start by discussing equity markets, but for March the big driver was interest rates. A quick glance at the table below shows the largest green box in the 1 month column belongs to 30-year treasuries, up 5.60% for the month – yes, just one month. This was driven by the 25-30 basis point (0.25% - 0.30%) drop in rates for March. Most of that change in rates came after the FOMC meeting on March 20 when the committee cited global economic developments along with continued muted inflation to reiterate their patient stance from earlier in year:

“The Committee continues to view sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective as the most likely outcomes. In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.”

Corporate bonds and REITs also benefited from the large drop in rates. In fact, US REITs have the largest YTD gain across the major asset classes in the table, something I did not expect at the beginning of the year, and also something that can turn quickly if rates reverse course.

With the equity markets, US large caps continued the strong trend higher on the back of an accommodative Fed and technology resurgence. Small caps didn’t fare as well, as some investors worried about an upcoming recession and its impact on domestic companies. These concerns – perhaps overblown – were driven by the 3m/10year curve inversion (short rates higher than long) and reiteration of the Fed’s patient stance. At the sector level, financials were down over 2.5% for the month due to falling rates and impact on net margin. Global equities keep plugging along, despite the ongoing Brexit challenges and trade negotiations.

On the economic front (in addition to the Fed activity), the number of jobs created was low but the unemployment rate dropped back to 3.8% and wage inflation continued to rise, bringing the yearly change to +3.4%. However, broader inflation measures remain in check for now. Inflation measures and Fed speakers bear continued monitoring.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com