Asset Class Returns - 2/28/2019

March - in like a lion, out like a lamb. But if the markets come in like a bull, they go out like a ???

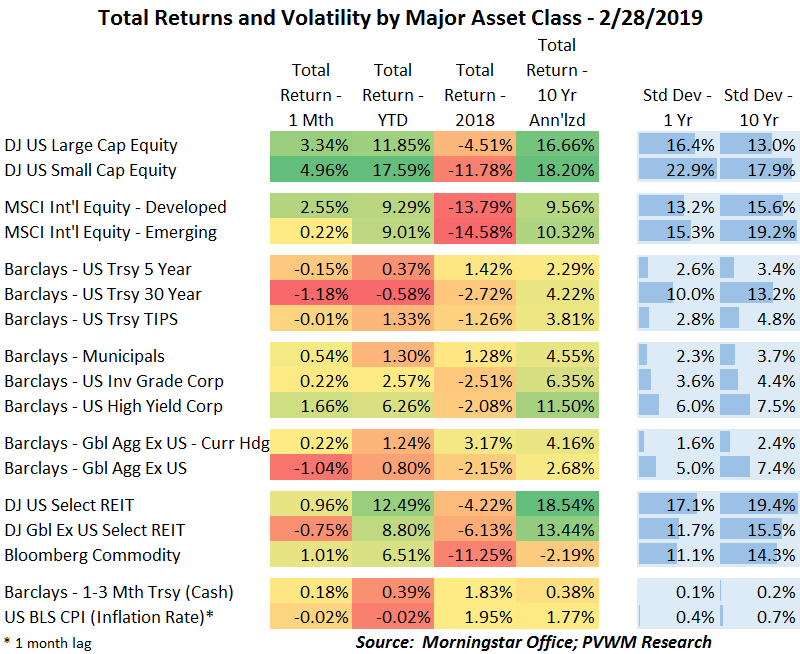

February equity returns were not as strong as January but still very solid. One could glance at the YTD returns in the table below and wonder if those were for a full year rather than two months. Admittedly these returns are off the steep losses from late last year but an impressive recovery nonetheless. Overall index levels are back near mid-October levels, though not above the peaks of September. The themes that drove the markets in January are still in place – a patient Fed, economic data not moving toward a recession and progress on trade negotiations. The US small cap equity index stands out relative to the other equity asset classes on a YTD basis but it also fell further late last year.

Unlike January, there are a few asset classes with negative monthly returns, mostly in fixed income and interest sensitive sectors like REITs, as rates drifted slightly higher. There was only a small move higher in rates but recall the effect longer maturities have on price impact as noted by the difference in 5-year vs. 30-year treasury index below. Rates were up over 10 basis points (0.10%) the last couple days on the back of quarterly GDP up 2.6% on annualized basis and up 3.1% from 12 months ago.

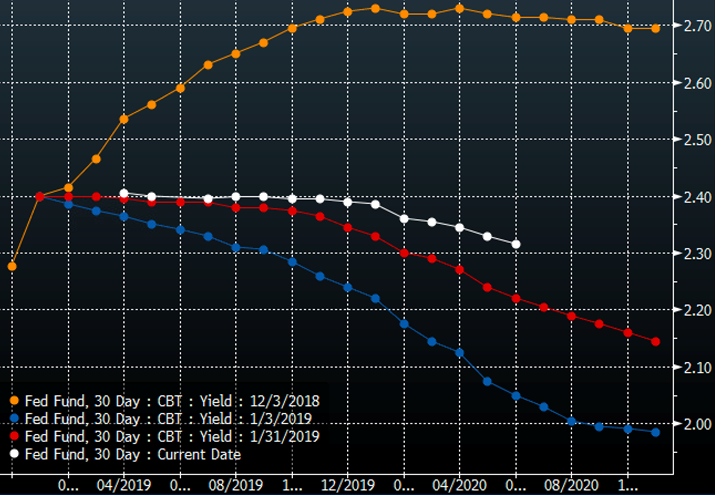

The Fed told us it will remain patient and wait for signs of inflation to develop. But solid economic data is causing some of the 'patient forever' and ‘next move is a rate cut’ to be priced out of the market. As I mentioned in the past, I was surprised how fast the Fed Funds futures market priced out future rate hikes during December, but a recent Bloomberg graph shows some of that is being reversed. The Fed removed the rate tightening bias from its policy statement but Fed officials clarified recently that doesn’t mean cutting rates is the baseline view.

Enjoy the coming spring!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com