Asset Class Returns - 1/31/2024

The first week of 2024 saw an initial hangover in the markets but the electrolytes of many Fed rate cut expectations for 2024 provided a boost to the markets later in the month. Looking under the hood however, it was a continuation of the story from 2023 – a few major tech-related names leading the S&P 500 index higher. Other asset classes, not so much.

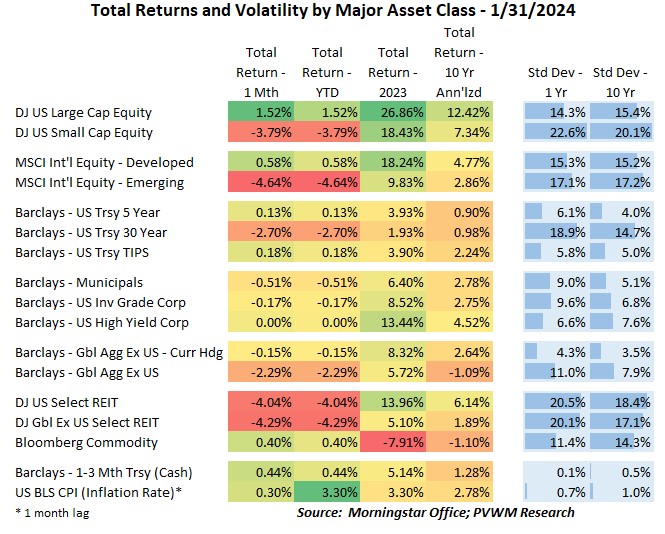

A quick glance at the table above shows mostly a flat to down month of returns with the exception being US Large caps. Once again, there is a large dispersion in the US between large caps at +1.5% and small caps at -3.8%. In international markets, developed is +0.5% while emerging down -4.6%, mostly driven by China. Much of the pullback in most markets occurred on the last day of the month when the FOMC once again reminded the markets – in stronger terms than at the December meeting – that rate cuts should not be expected early in the year and very likely fewer than the market was pricing in. Surprisingly the longer-term interest rates fell on that news but all of that has been reversed this morning (Feb 2nd) after the release of a red-hot jobs report. REITs are also on the negative side for the month. They were negative throughout the month and certainly won’t be helped by higher rates, or the end-of-month real estate loan concerns from regional banks.

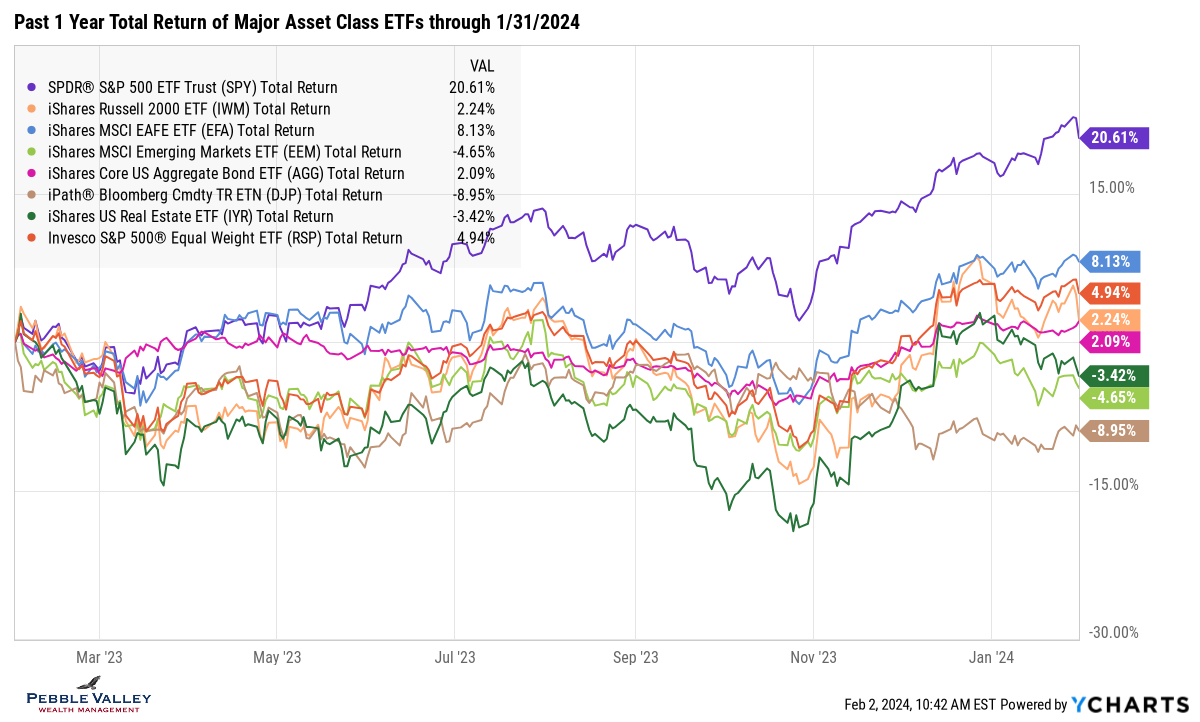

The graph below shows total returns of major asset class ETFs over the past year (total return includes reinvested interest and dividends). I added a new ETF this month – an equal-weighted S&P index (ticker RSP). Note most index-related ETFs are market weighted, meaning returns captured are weighted by the company’s market capitalization. Over the past couple years technology-related companies have been dominating the S&P. An equal-weighted index includes the same weighting for all the holdings. The dispersion between the market-weighted and equal-weighted index (as captured by ETFs) is quite wide over the past year – up +20.61% for market-cap weighted and only +4.94% for equal-weighted. Something to be aware of. The REIT line (dark green) also caught my attention. The strong rally from late October through year-end was quite pronounced and surprising, but that is cooling quickly due to comments from the paragraph above.

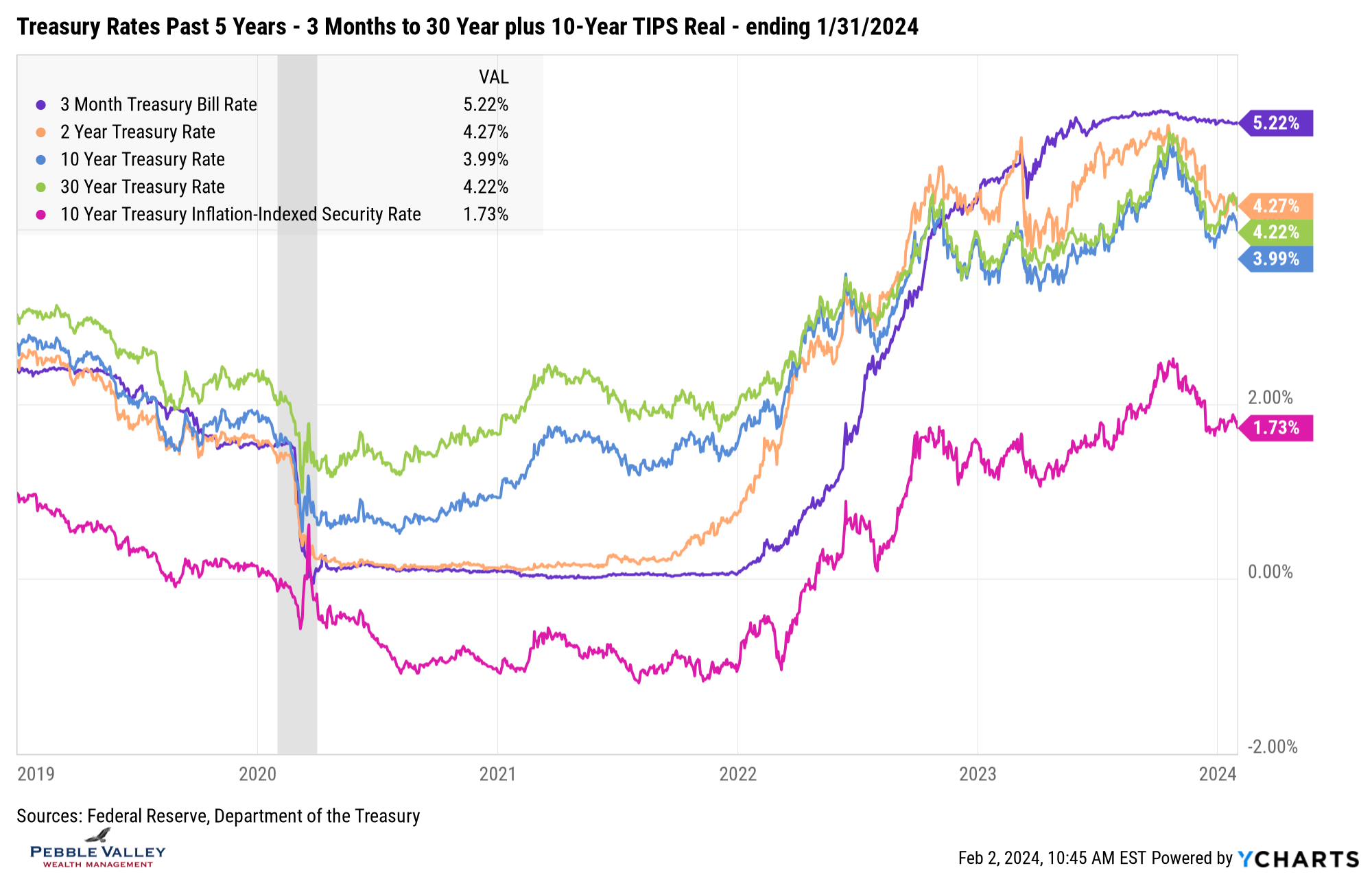

Treasury rates were starting to drift up during the month of January but reversed course quite dramatically during the last week of the month. One driver pushing rates lower was the Treasury announced additional funding needs late in January that were lower than the market expected. As mentioned above, rates are reversing course (going back up) quite violently on this second day of February. Maybe the bond market saw a shadow! TIPS bond performance from a total return perspective can be non-intuitive – inflation was high in ’23 yet TIPS had a loss – but the real yield of TIPS (the magenta line – there I said it) will be interesting to watch along with inflation readings.

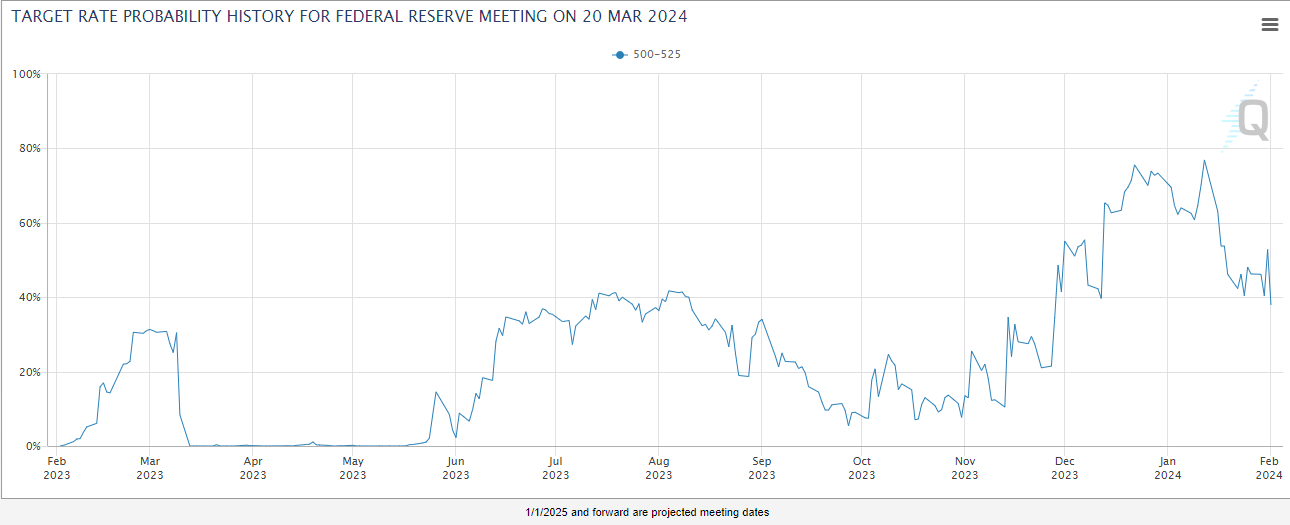

The latest FOMC meeting concluded January 31st. Once again there was no rate change as expected, but the more hawkish tone returned after the surprisingly dovish tone during the December meeting press conference. Prior to the meeting, Fed Funds futures was pricing in close to an 80% chance of a rate cut at the March FOMC meeting. Some of that air was let out prior to the FOMC meeting, and then dropped below 40% after but still higher than I would have expected. After the jobs report this morning that will be dropping even further. While the rate cut for March 20th meeting is being priced out, we will get an updated Summary of Economic Projections – so that will be fun. We will also have a few more inflation prints and another jobs report before then.

The special topic this month is technology. We are currently completing the implementation of a new system for our business. The initial scope of our project was limited to a particular system, but as we progressed and saw more opportunities to streamline, we kept replacing or consolidating a few more systems. It has been a busy time, but going through the process has been invigorating and “productivity enhancing”. Our firm is always on the lookout to keep up with the latest technology to deliver our best to you. Next up for me, utilizing a couple of the AI tools to request “compare the last two FOMC statements and provide a red-line comparison.” There were some significant changes – relative to FOMC statement changes that is.

Go ‘Niners!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com