Asset Class Returns - 12/31/2020

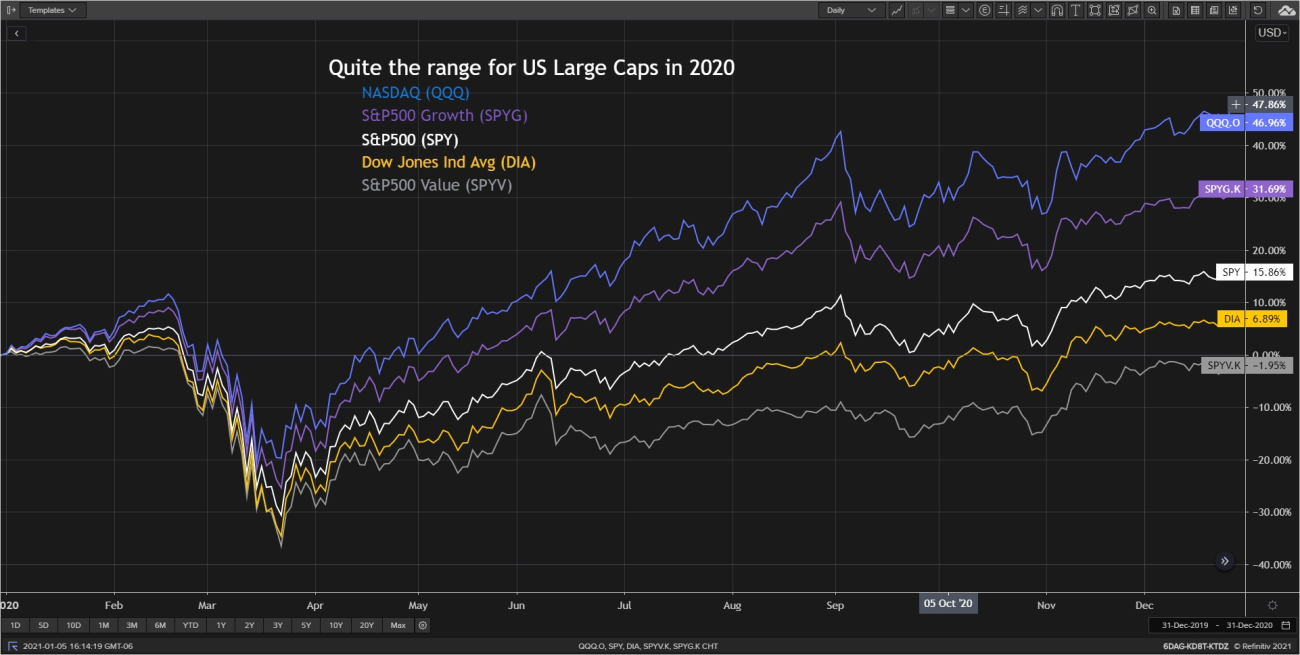

While reviewing year-end returns last week, I made a mental note to use three common equity indices – NASDAQ, S&P500 and Dow Jones Industrial Average – rather than my typical growth vs. value indices that readers may be less familiar with to capture the theme of dispersion in the markets. NASDAQ not only captures the growth theme but also the dominant technology sector. DJIA is comprised of more established companies and contains more than a few value stocks. The graph below captures this amazing spread in returns – again, all in a single asset class. I added the growth and value ETF returns for context.

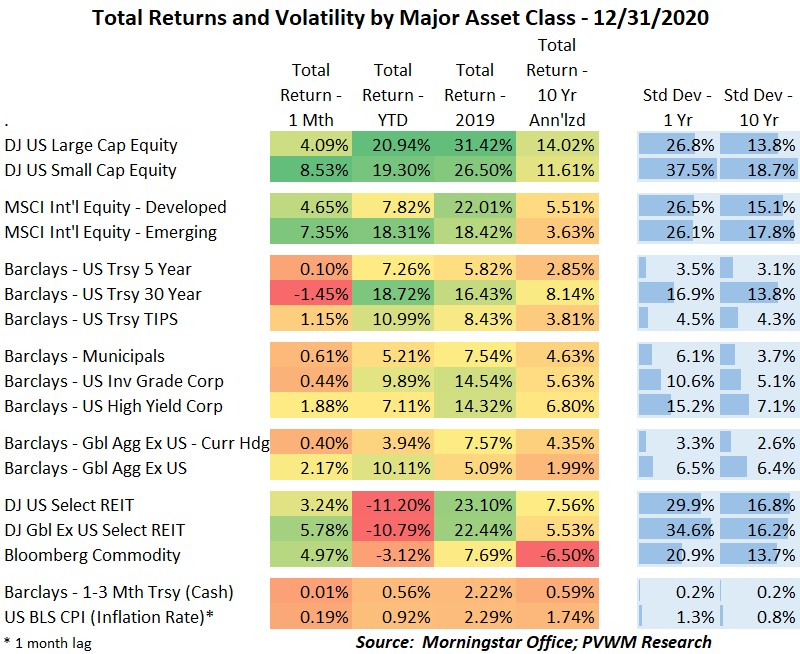

Shifting over to the major asset class graph, you can see US small caps continued its strong run into December and ended the year on top after lagging most of the year. US large caps were up only slightly for December. International equity – both developed and emerging markets - continued the strong run on the back of a weaker dollar. The weaker dollar also helped commodities, but not enough to move into positive territory for the year. At the sector level, financials led the pack for the month. Energy popped about 13% early in December but settled back to just over 3% by month-end. Even bonds had a solid return as rates stayed low. This WSJ article with the ‘Everything Rally’ in the title is fitting.

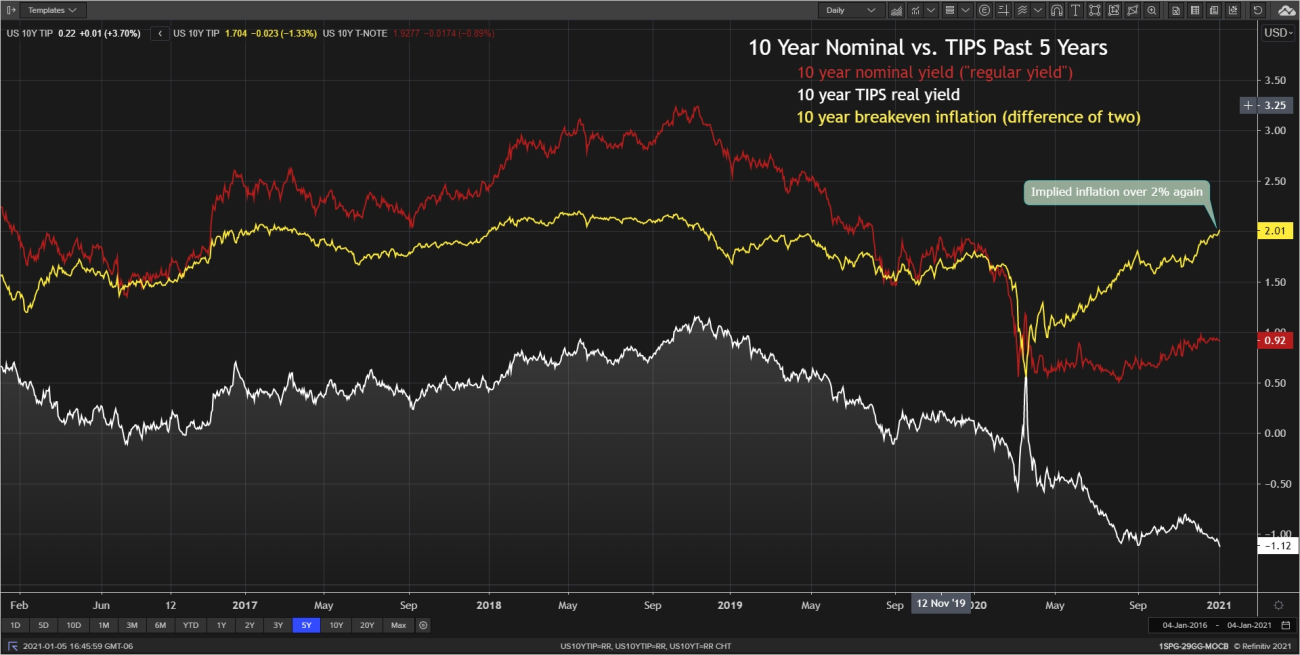

Treasury rates remained relatively stable for nominal yields in December with a continued slow drift upward. But the market’s expectations for inflation on the back of the new stimulus bill is moving up faster than a slow drift, up over 2% early in 2021. This pushes the real yield of TIPS even more negative, going below -1.10%. Note for TIPS the principal amount is adjusted based on the growth of actual CPI to make up the difference in yield vs. the nominal bond. It will be interesting to see how long maturity nominal yields move near term. Probably a good time to brush up on your bond holdings’ duration.

The Federal Reserve updated its economic projections at the December meeting. There was a noticeable improvement in the GDP growth and unemployment rate for the next couple years relative to the September projection. What didn’t change much was the inflation projection – projected to stay below 2% until 2023 – and all but one member expecting to keep short-term rates at current low levels until 2023. I can’t reconcile the stronger growth projections with the accommodative rate policy, especially on the back of continued fiscal policy. We will have to see what bond market participants think of this during the year (refer to TIPS graph above).

Happy New Year!

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com