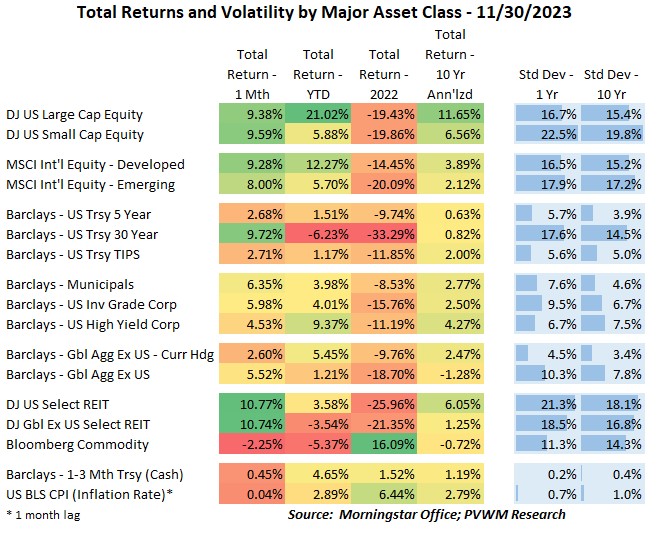

Asset Class Returns - 11/30/2023

The month of November had an extremely strong performance. If looking for a one sentence summary:

Equities were up about 10% for the month and bonds up about 5% while the only negative was commodities, down about 2% due to energy and livestock.

What led to such a strong month you ask?

- A market-perceived dovish FOMC meeting Nov 1st (I think overreaction – more later)

- Treasury announcing fewer bonds and more bills in quarterly auction plans on Nov 1st

- Continued trend down in inflation rate – though still quite positive and far way from 2%

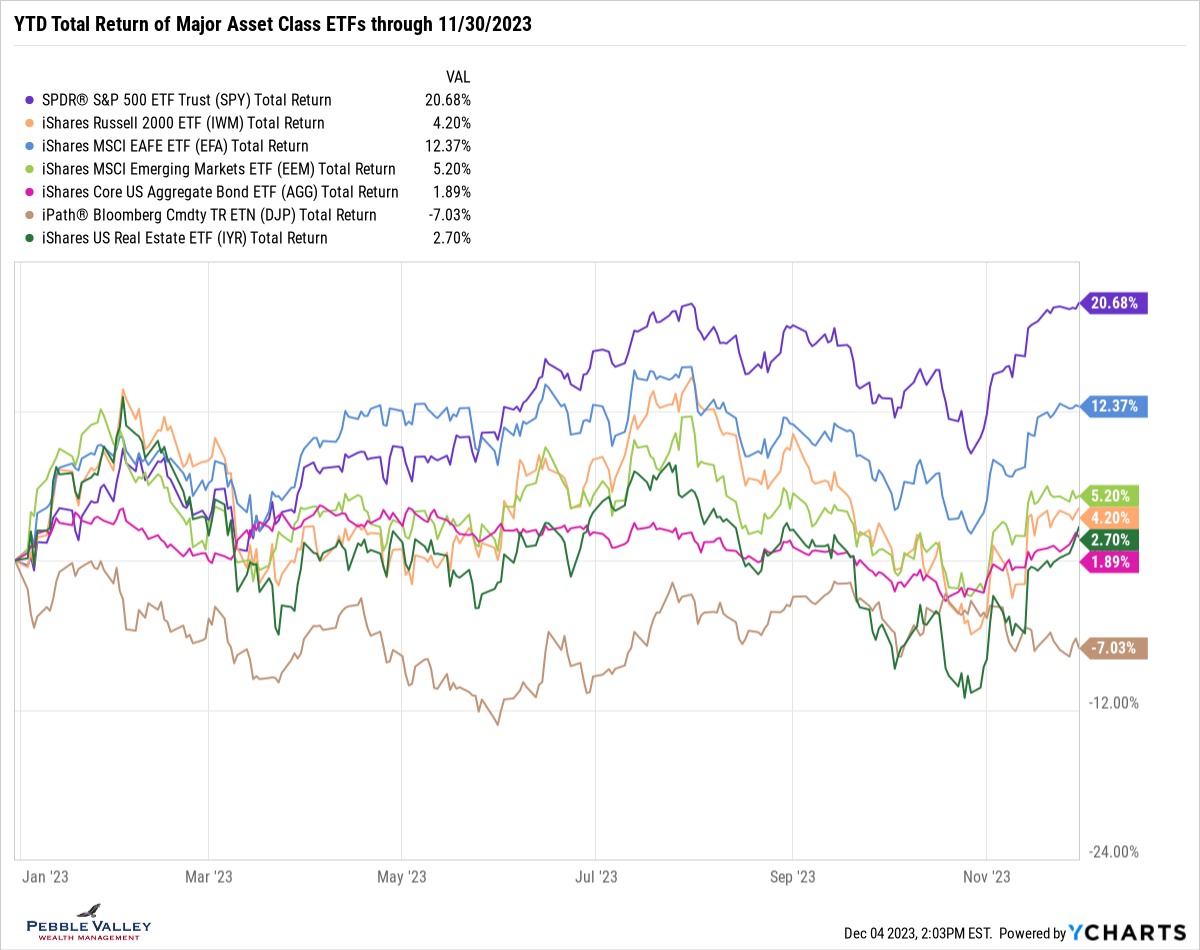

The graph below shows YTD total returns of major asset class ETFs. Recall these graphs now show total return (includes reinvested interest and dividends) and not just price return. You can see the moonshot from the end of October for all except commodities (brown line). While the move was shocking for all asset classes, REITs stood out the most to me as they registered close to an 11% return for the month alone, bringing them positive on a YTD basis. Yes, I know interest rates fell substantially (see next section) and this asset class is rate sensitive, but many of the fundamental issues remain with this asset class. Momentum is a strong force.

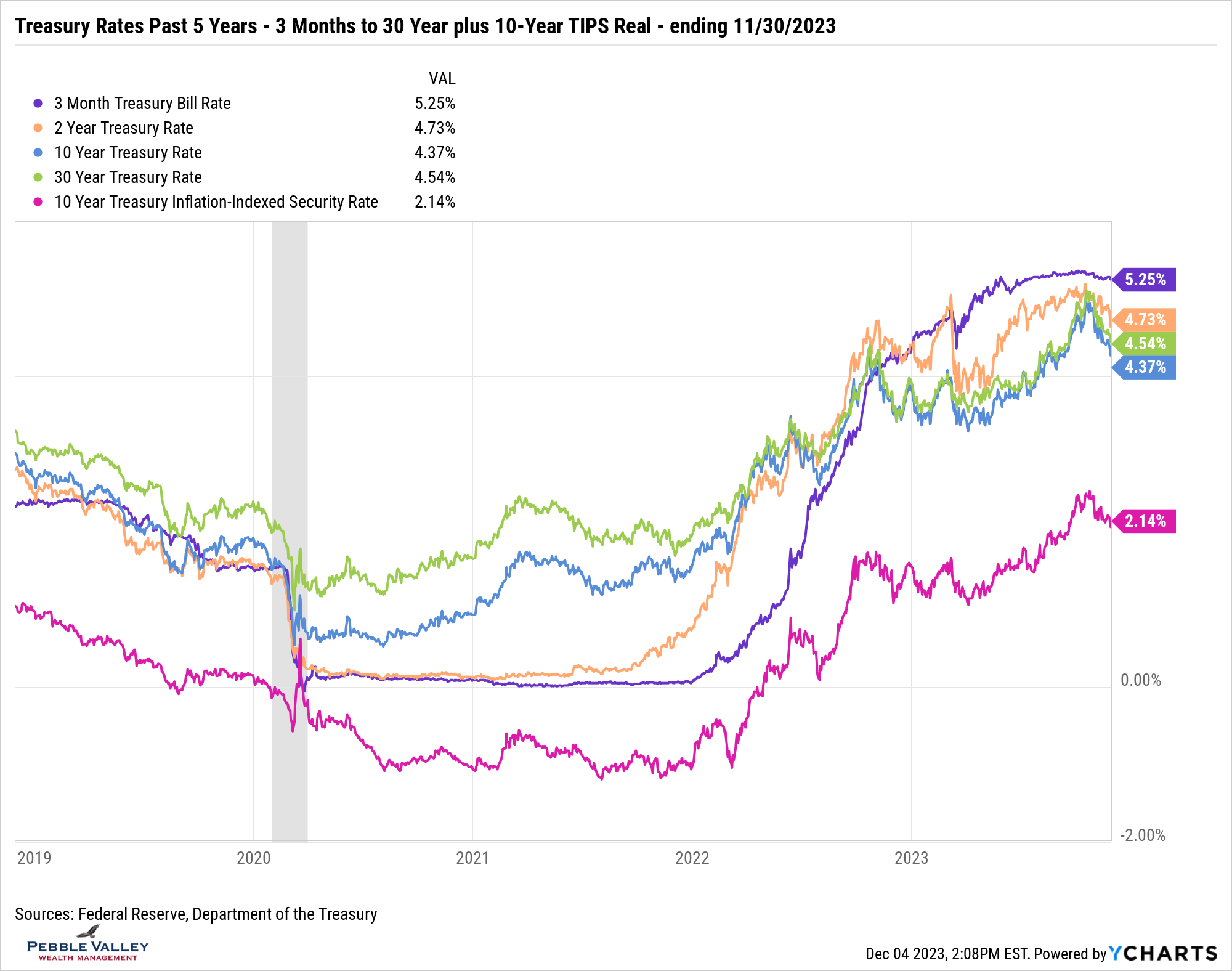

So much for the longer end of the curve marching higher – at least for this past month. Rates fell substantially across the curve, with 2-year rates falling about 0.35% while the 10- and 30-year fell over 0.50%. Even the real yield from 10-year TIPS (red line) fell over 0.30%. It appears the bond vigilantes have stepped back this month, perhaps getting run over by technical as funds reposition based on the latest Fed view (see next section). And while the move in rates this month to the downside was swift, don’t forget the swift rise in rates since mid-September after the previous FOMC meeting and the Fed’s updated economic projections. We are now only back to those mid-September levels. As a friendly reminder, the Fed continues to let $95 billion roll off the balance sheet each month and the Treasury must continue to finance a large budget deficit.

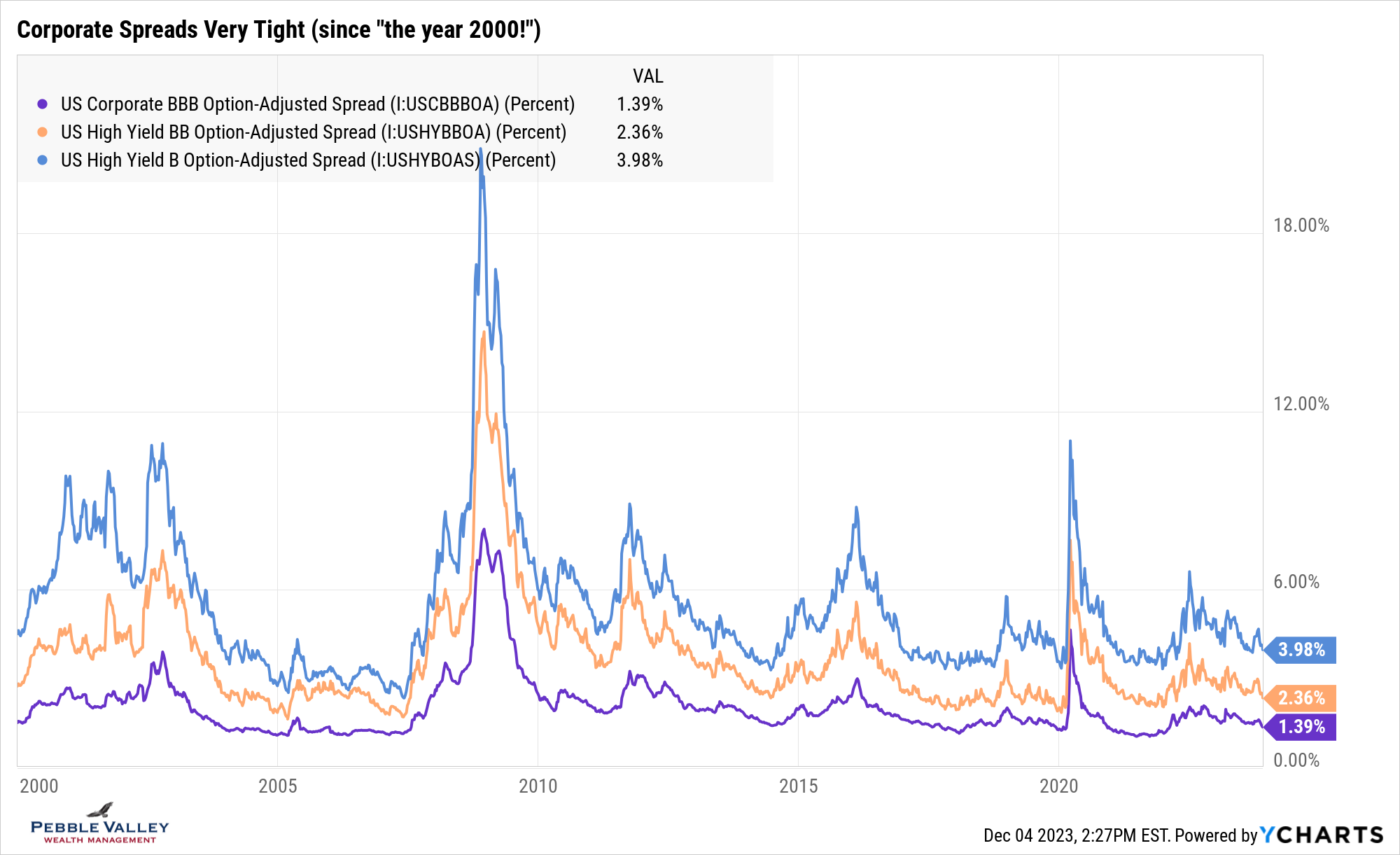

This month I am taking the bond section a layer deeper. I mentioned in the lead-in paragraph that bond total returns were “up about 5%” for the month. This was referencing the corporate bond index. That initially struck me as high given “only” a 0.50% drop in rates and applying my quick bond-duration math. However, in the spirit of smokin’, notice the credit spreads (the extra yield received for investing in riskier bonds) also tightened noticeably in November, adding further gains. As you can see in the graph below, these are very tight spreads – low implied risk – historically speaking. Again, for now.

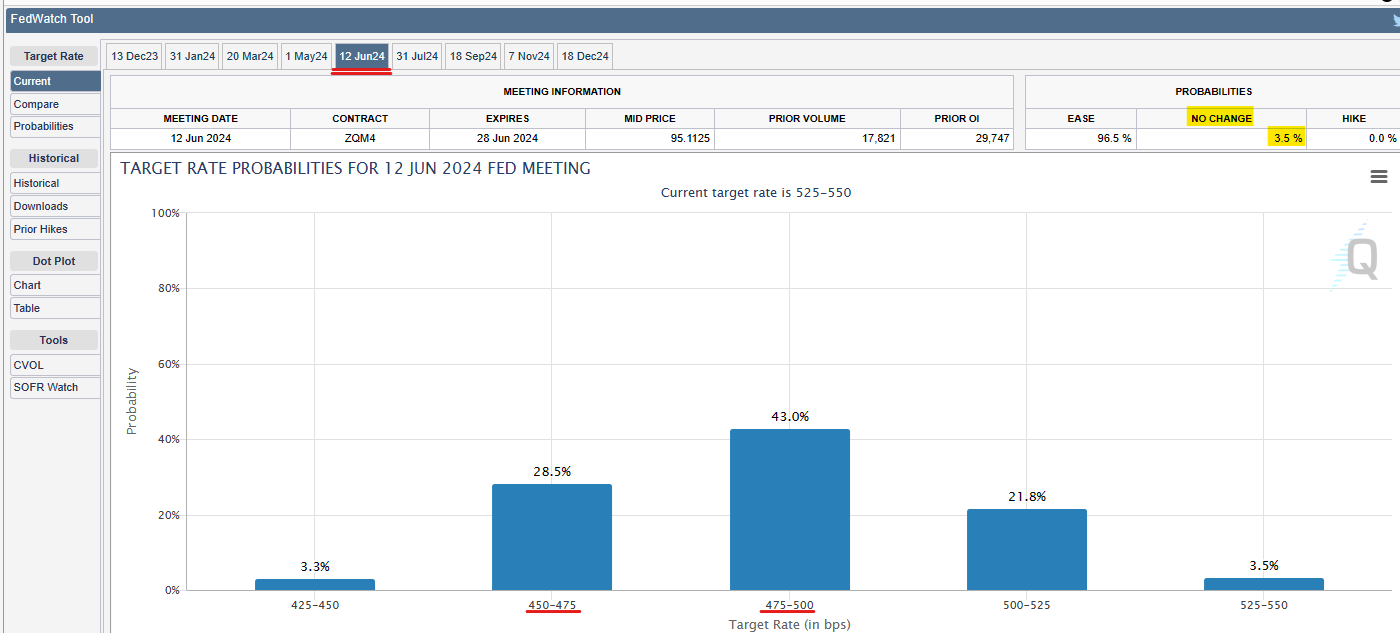

As mentioned in last month’s blog, the latest FOMC meeting concluded November 1st. As expected, the Fed didn’t raise short-term rates and the statement had very few changes. Recall the next Summary of Economic Projections will be released at the December 13th meeting. The inflation readings since the Nov 1 meeting have been tame and continue to head in the right direction. This gave the bond market more reason to buy bonds which lowers the yield. At a recent speech Fed Chair Powell reminded listeners that the Fed is not currently considering lower rates and expect to keep rates higher until inflation is well on its way to the 2% inflation target. The market disagrees and is expecting Fed rate cuts starting early in 2024. Using the CME Fedwatch tool, Fed Funds futures imply a greater than 50% chance of at least one rate cut by the March 2024 meeting. By the June 2024 meeting, expectations are almost certain to have at least one rate cut – and likely a couple more. This feels overdone.

The special topic this month is a friendly reminder of the two topics from last month:

- Year-end tax planning. Be sure to take care of any year-end moves:

- complete required distributions from IRAs, 401ks (if not employed and didn’t roll)

- make any charitable contributions (via QCD, DAF or directly)

- partial Roth conversions if your tax situation warrants.

- funding 529 college plans if state deduction

- tax-loss harvesting, though should be doing throughout the year

- note: can make 2023 tax-year contributions to IRAs and HSAs through next spring

- I Bond rate reset. The latest reset (occurs each May and Nov 1st) for new contributions over the next 6 months is 5.27% which includes a fixed-rate component of 1.3%. Individuals with previous 0% fixed rate I Bonds should consider cashing in (if held at least 12 months, lose last 3 months’ interest, pay Fed taxes), then purchase a new I bond with this attractive 1.3% fixed rate for life of I Bond. Be aware, still subject to $10,000 per year per person/entity of new money so if already purchased 2023 max must wait until January 2024.

December is here. May the first half of the month be as exciting as the last half.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com