Asset Class Returns - 11/30/2020

November was mostly a moonshot for all markets. Recall markets were weak toward the end of October as the election approached and a fiscal COVID relief bill with a chance of passing stalled in the House. That proved to be the recent low as it appears the COVID relief will come in the form of vaccines – developed, trialed and expected to be approved much sooner than almost everyone expected. Not only one but three vaccines were announced on successive Mondays throughout November. I like Mondays…

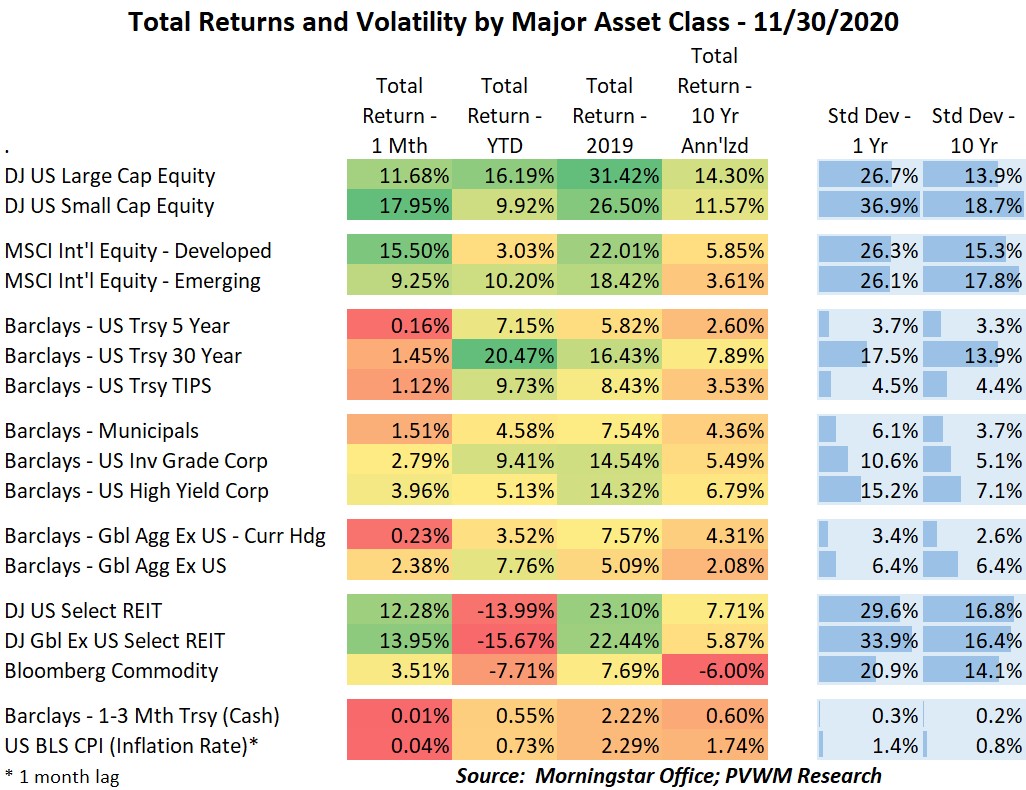

The strong rally brought many asset classes into positive territory on a YTD basis. REITs and commodities remain in the red for the year. Within markets, US small caps made up major ground on large caps but still lag YTD. Across the pond, developed markets also had a monster month, partially on back of weaker dollar, but still trails the emerging markets YTD.

Back in the US, the beaten-down sectors mostly in the value category came back to life. While the energy and financial sector are at the bottom YTD, the month of November saw a 23+% and 14+% returns. These two sectors only make up about 2.5% and 8.5% of the S&P500 respectively. Surprisingly the growth vs. value performance differential is still quite wide at about 30% YTD, with the nod to growth.

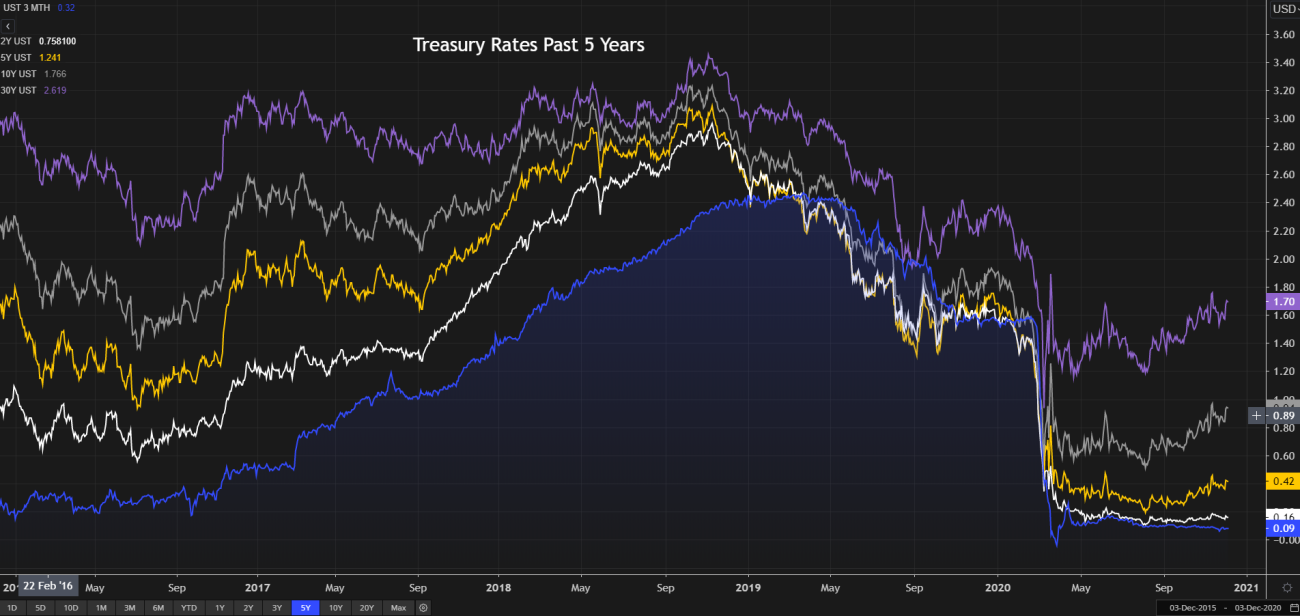

Treasury rates remained stable to down slightly, leading to small gains for the month. However, with the benefit of seeing the first two days of December, longer maturity bond rates are rising again as talks of COVID relief bill back on the table. This means more spending => requiring more borrowing => more treasury bonds issued => extra supply => lower price for bonds in excess supply => higher rates. This potential excess debt issuance along with higher economic activity in 2021 is also leading to higher “break-even inflation rate” implied by the TIPS market. Another impact of higher rates is the potential lower valuation of faster growing companies with earnings many years into the future. Just like with bonds, when you discount those future cash flow streams (earnings) back at a higher rate the value goes down.

Enjoy the final month of the year and all that it brings... including tax planning.