Asset Class Returns - 10/31/2021

Here is this month’s market summary. Unless noted, the time frame is year-to-date with screen-shots through 11/2/2021 am.

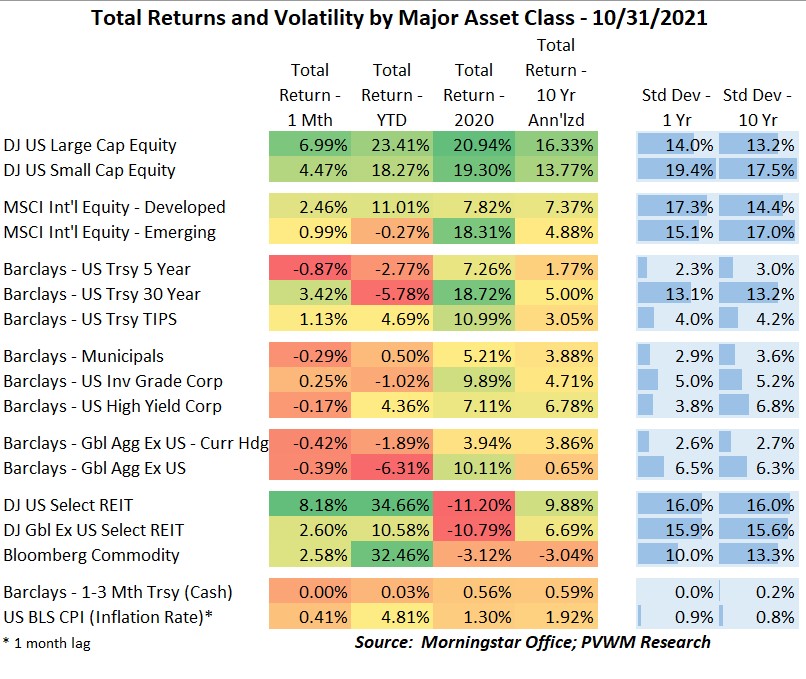

The eye-popping equity returns came back with a vengeance in October, reversing the September pullback. 3rd Quarter earnings and revenue guidance were favorable overall, but references to how companies will respond to higher inflation were also prevalent. The US Large Cap YTD return is now 23+% followed by Small Caps at 18+%. The international markets continue to lag, though bear in mind the US Dollar (as measured by DXY) is up over 4% YTD. This is a direct drag on int’l equity returns when converted back to US terms. Emerging markets continue to flat-line YTD though valuations remain attractive. The surprising flyer this month – US REITs. The shifting office and retail store dynamics seem to be offset by expected future rental increases and still low rates - for now.

I want to focus the remainder of this blog on inflation and rates, but I must mention two sectors that are performing even better than US REITs – energy and financials.

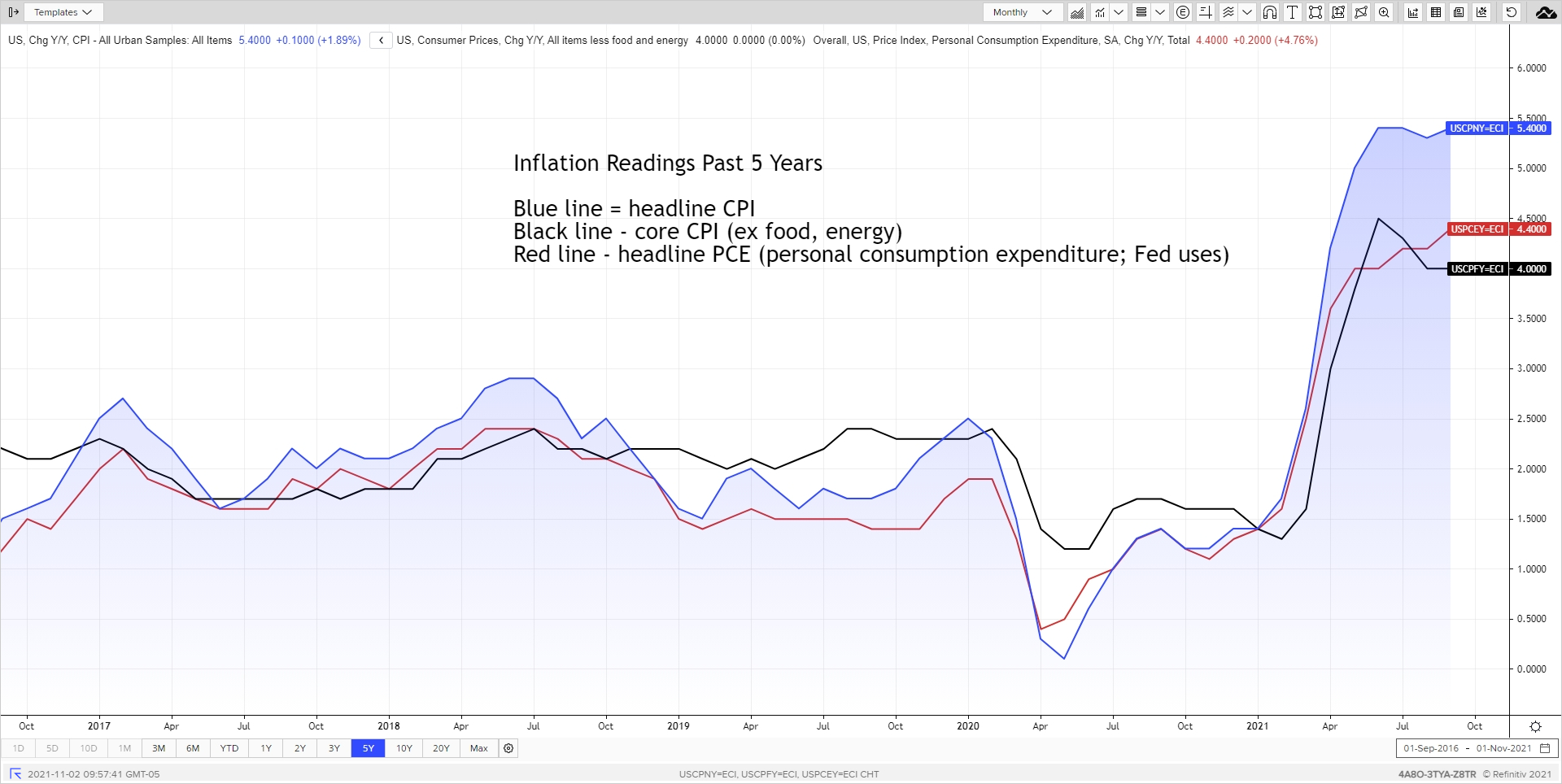

Hopefully you all read my blog post on the 5.9% inflation adjustment for Social Security benefits. The graph below shows different inflation readings and the large increases. The common measures shown include the mainstream CPI – both full measure and core (excludes food, energy) but also the Fed’s preferred CPE index. Wages are also on the rise.

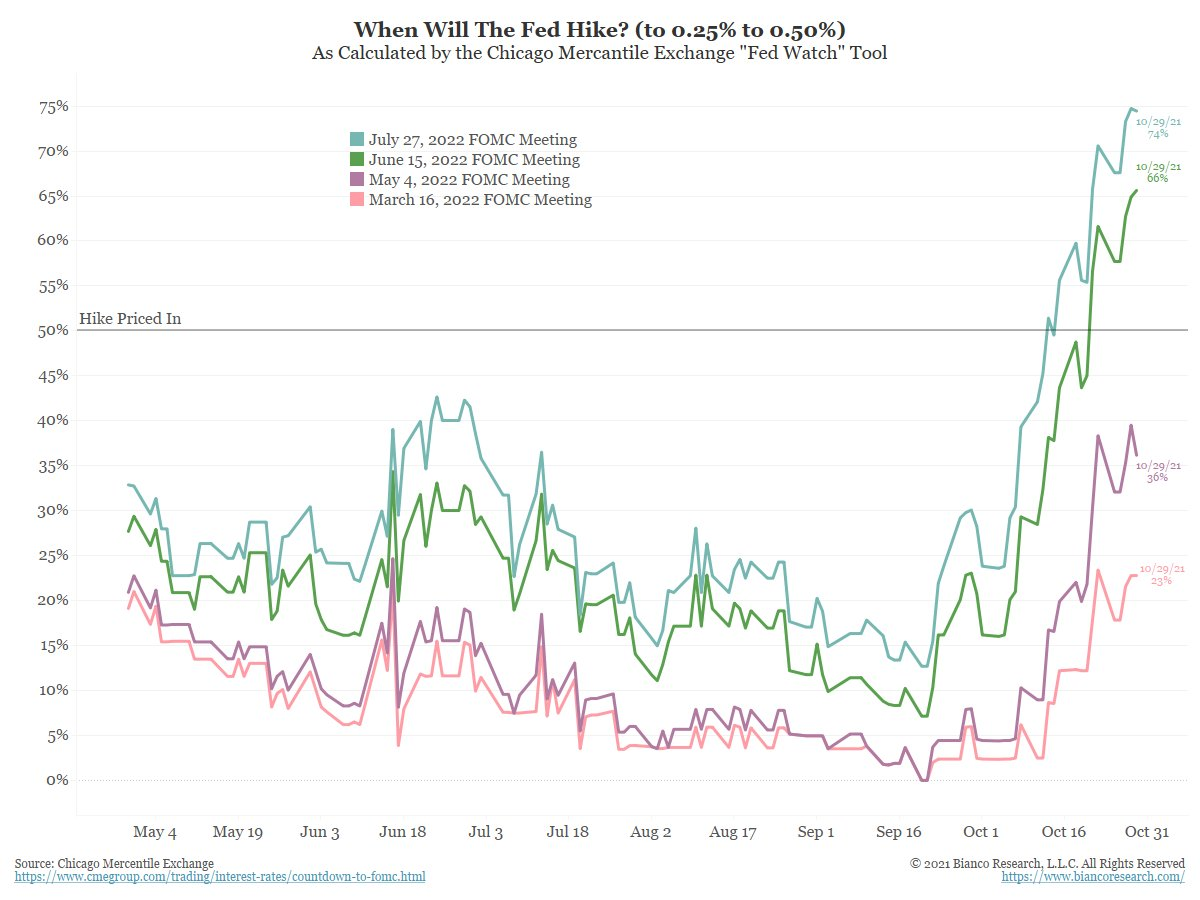

After months of the Federal Reserve referring to inflation as transitory, Fed Chair Powell recently referenced that supply-chain bottlenecks are adding to the inflationary pressure and may persist for longer. This caused the market to begin pricing in potential rate hikes sooner than 2023. This is in addition to the Fed very likely announcing the start of fewer bond purchases (called “tapering”) at the conclusion of the FOMC meeting tomorrow (11/3). The first chart shows treasury yields over time. Notice the relatively large moves in 2- and 5-year rates as Fed hikes get priced in. The second graph shows how much the potential for rate hikes has changed recently (Source: Bianco Research twitter feed).

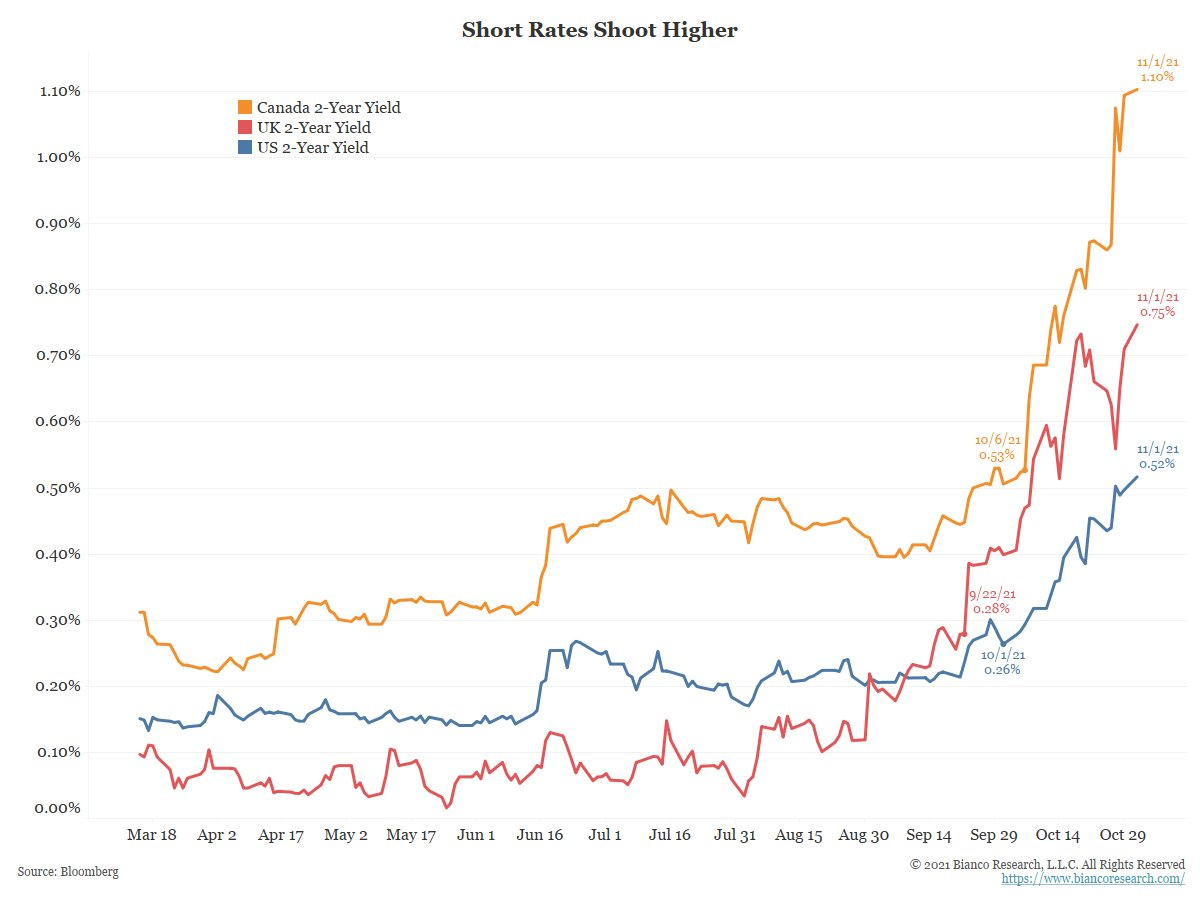

And the US is not alone in potential rate hikes. Over this past month Canada, Bank of England and Australia also hinted at raising rates soon. The graph below shows the 2-year yield for the US, Canada and UK (Source: Bianco Research twitter feed). And while these economies are smaller than the US, the marginal change in flows to countries with higher rates can impact the currencies of these countries. Dusting off my CFA-Level II studies, as short-term rates rise for a given country, new investors need to first buy that currency in order to invest in those rates, driving up the value of that currency.

59 days left in 2021! Make the most of them.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com