Asset Class Returns - 10/31/2020

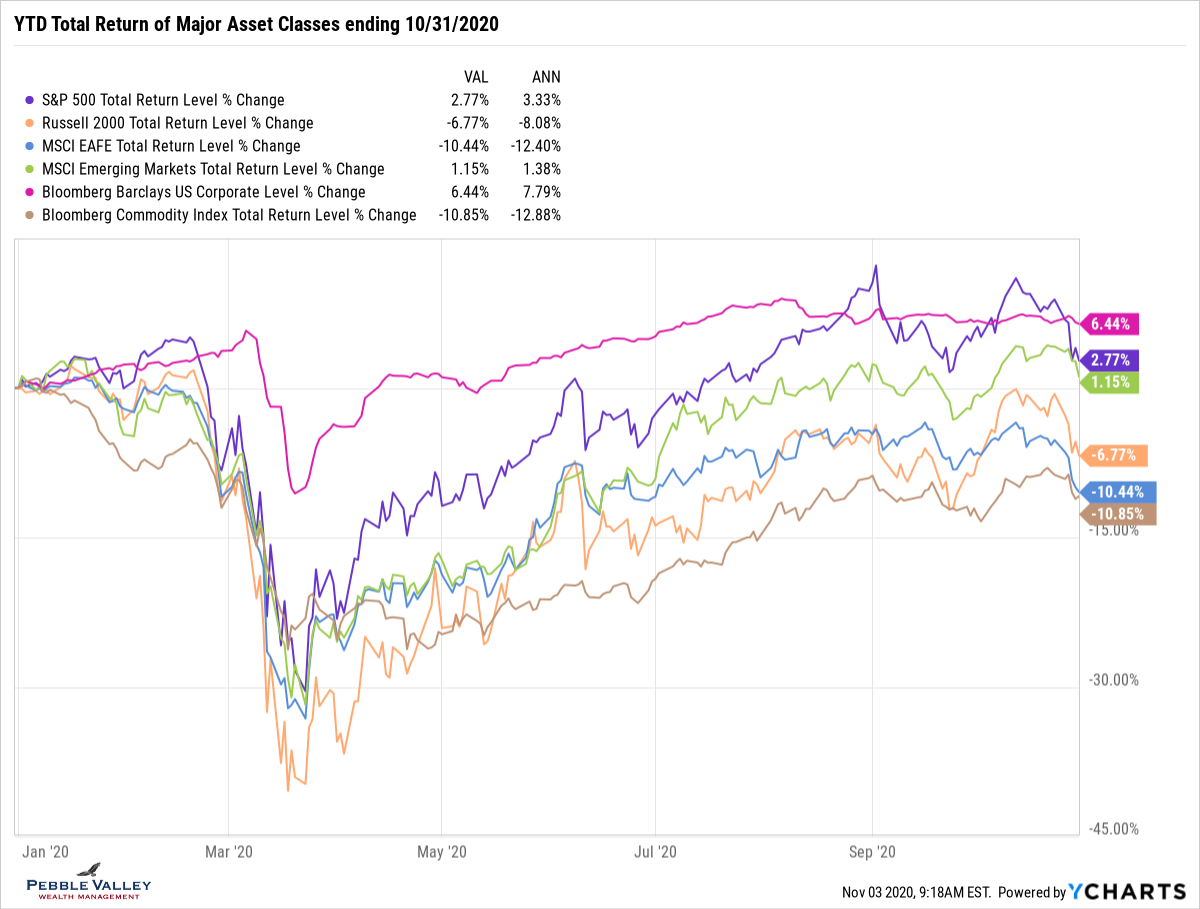

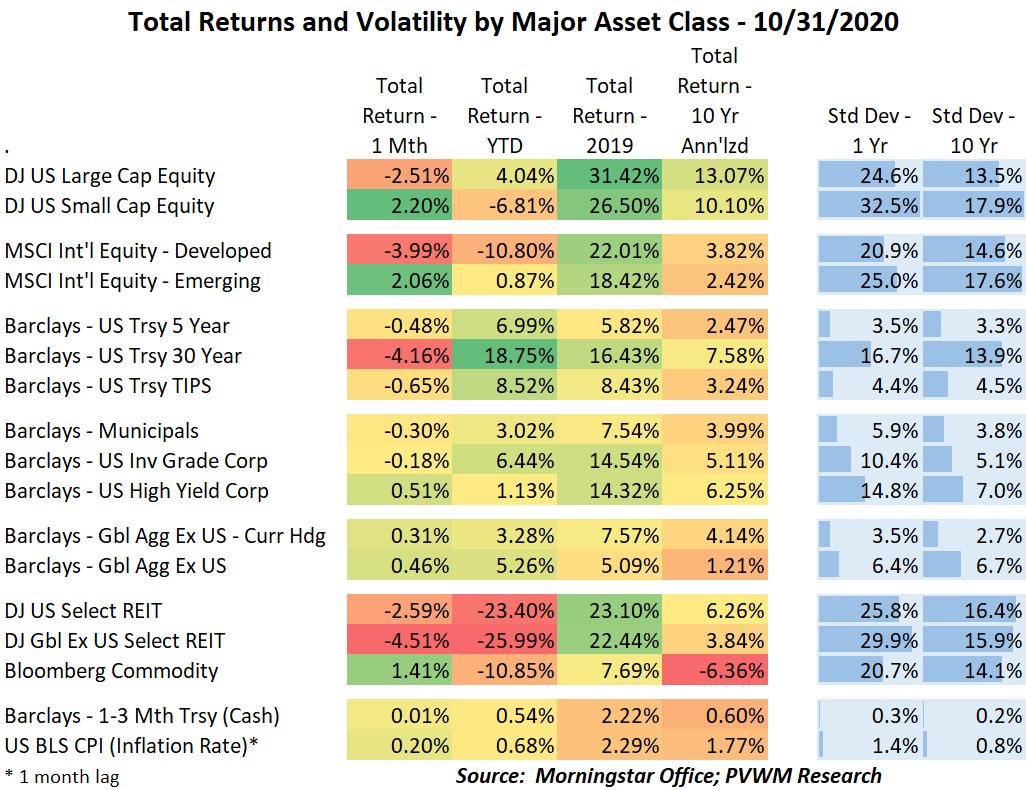

Equity markets started the month of October on a strong note, continuing the rally from late September. The markets turned down mid-month after the prospects of a new stimulus package became less likely. US Large Caps and International Developed markets fell harder than US Small Caps and Emerging Markets. The first week of November will bring an election, Fed meeting and jobs report. Buckle up!

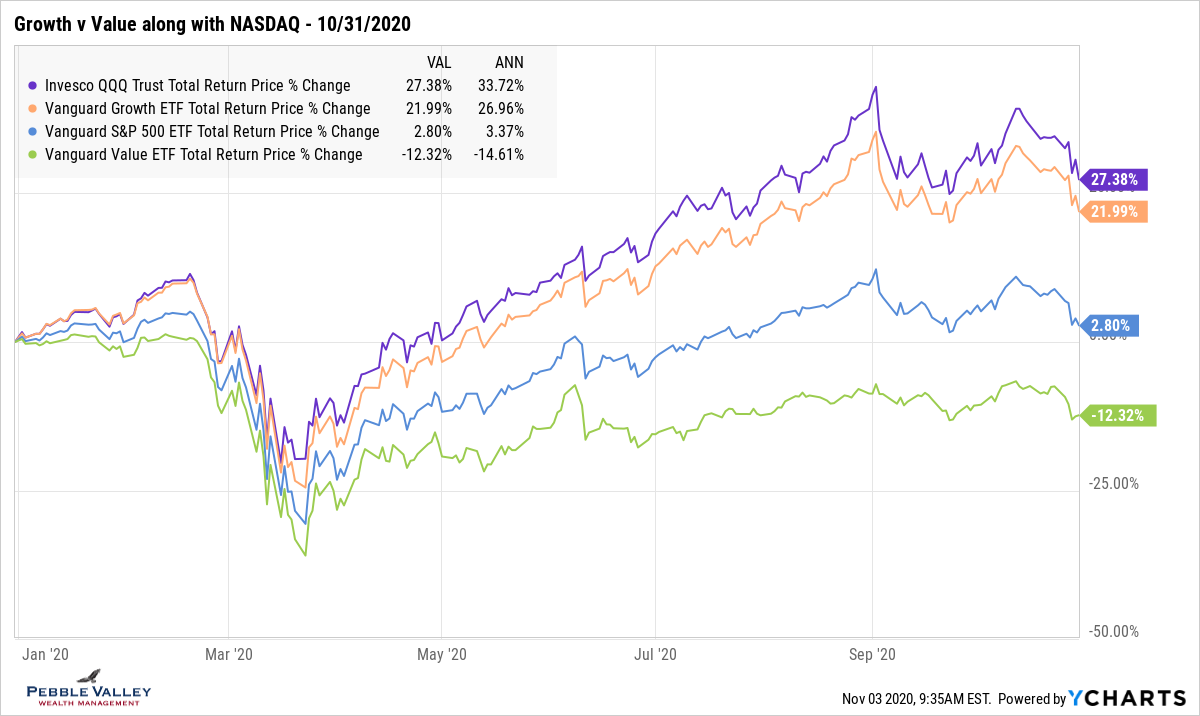

Growth stocks and in particular the technology sector has dominated the markets since the COVID sell-off in late March. I mentioned last month that trend cooled. The first part of October looked like a return to the old highs. However, the turn in sentiment mid-month was especially pronounced in this part of the market. Value stocks also pulled back and continue to lag the overall market. The YTD performance differential between growth and value remains at a very wide 35% area.

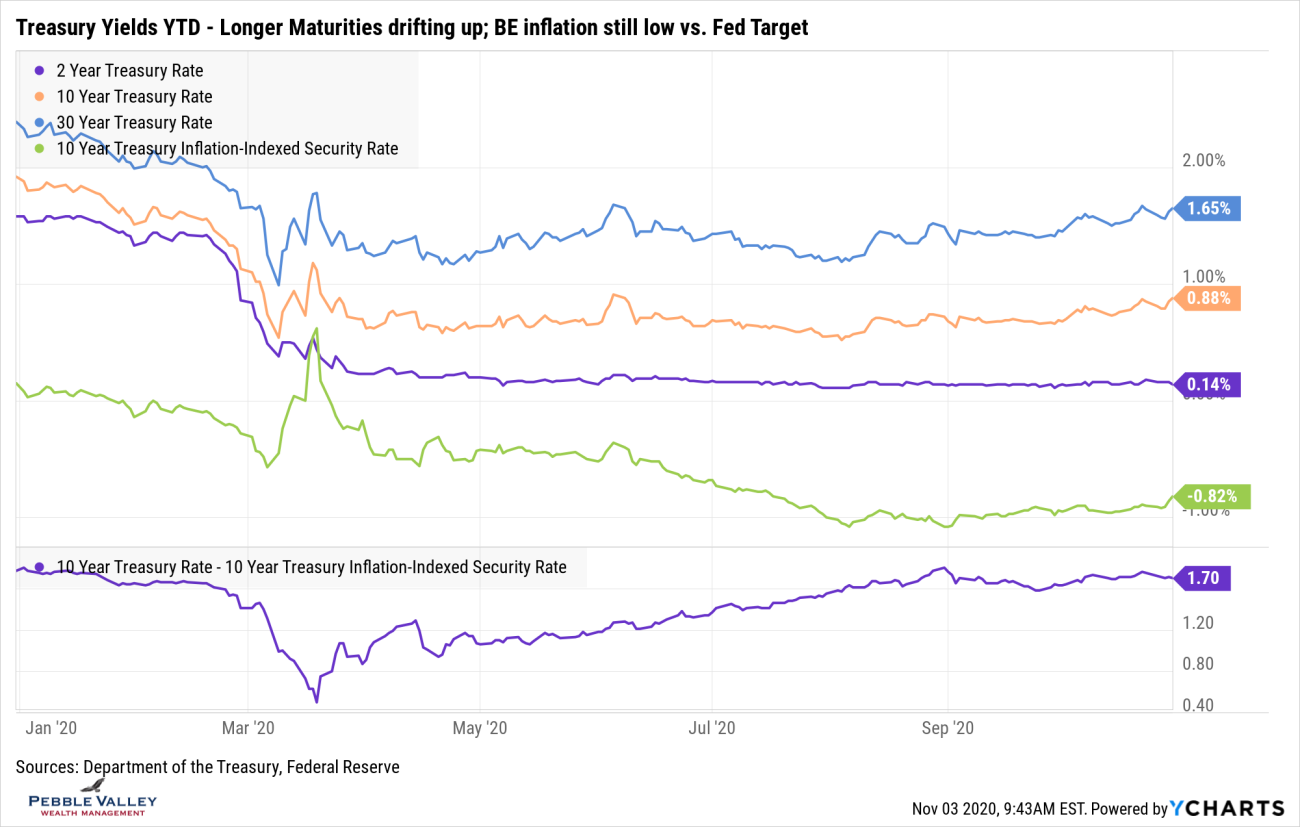

Treasury rates continued to drift higher for longer maturities. Even though another stimulus bill hasn’t been passed yet, the markets expect another one regardless of election results. Short maturity yields are expected to remain anchored as the Fed remains accommodative until inflation is solidly over its 2% target rate for some time. The graph below shows the key treasury yields, including the negative 10-year TIPS real yield (yes, that is -0.82% yield but also receive actual inflation rate). Recall the difference in yield between 10-year nominal treasury and 10-year TIPS is called the “break-even inflation rate” implied by the markets. While higher for the year, it is still at a very low 1.70% level given the Fed’s stated intention. The next Fed meeting concludes 11/5.

Make the most out of your last two months of 2020. “The days are long, but the years are lightning. They’re bright, and they will never strike again.” - Tanya Tucker, Bring My Flowers Now

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com