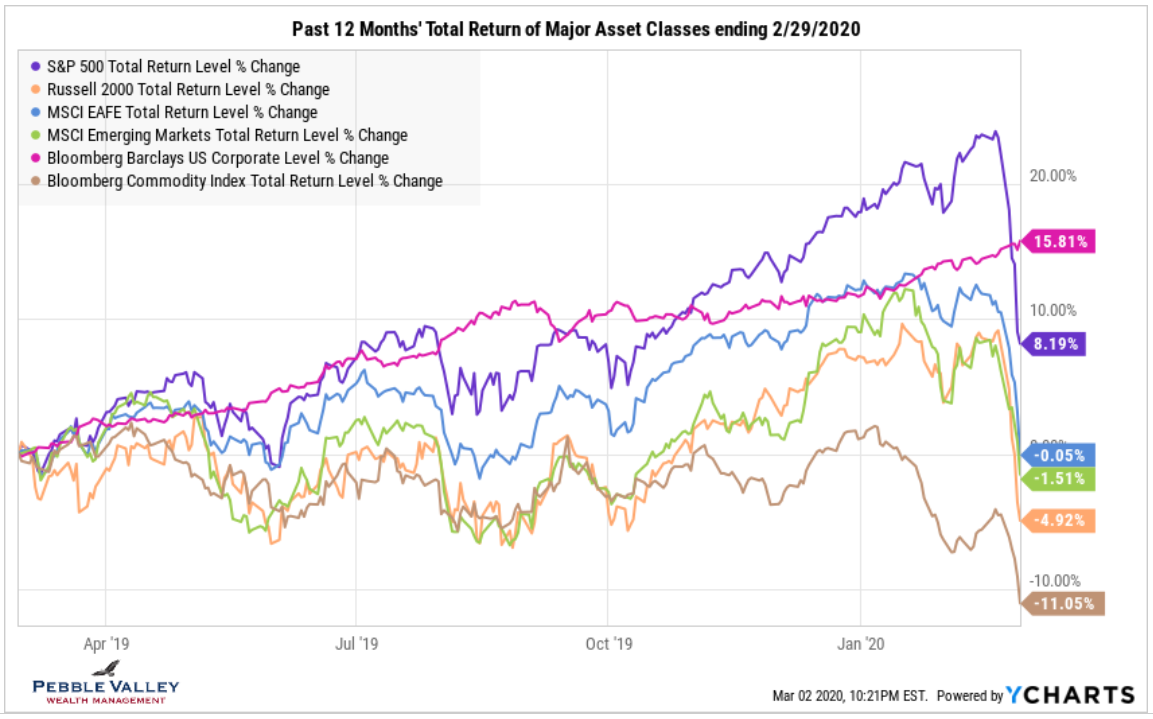

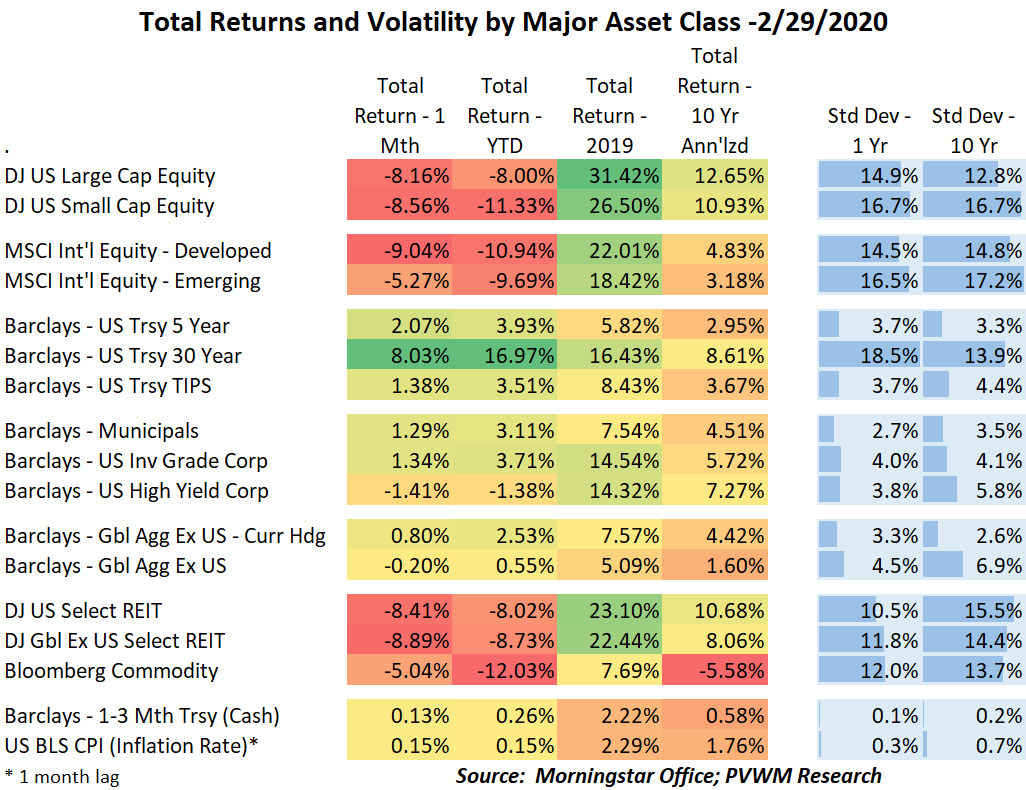

Asset Class Returns - 02/29/2020

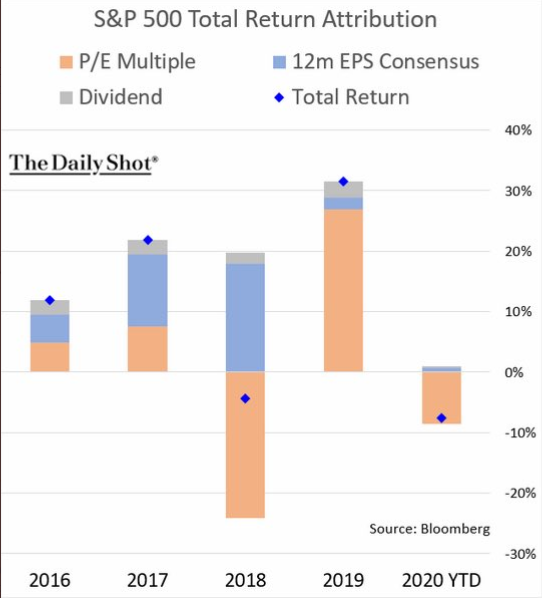

There was a very swift drawdown on risky markets the last week of this month on coronavirus concerns. Last month the focus was on the number of reported cases and resulting deaths versus past outbreaks. Initially while contained to a single country, the impact of quarantines was not significant on the global economy. However, as the number of countries reporting cases went global the economic impact increased. If the disruption is short-lived and demand simply delayed, the longer-term economic impact can be muted. If not, future earnings will be impacted and could push some countries into a recession. Lower earnings lead to lower stock prices since the market is a forward-expectations pricing mechanism. The earnings multiple investors are willing to pay is also a lot lower than it was in 2019 (see second graph).

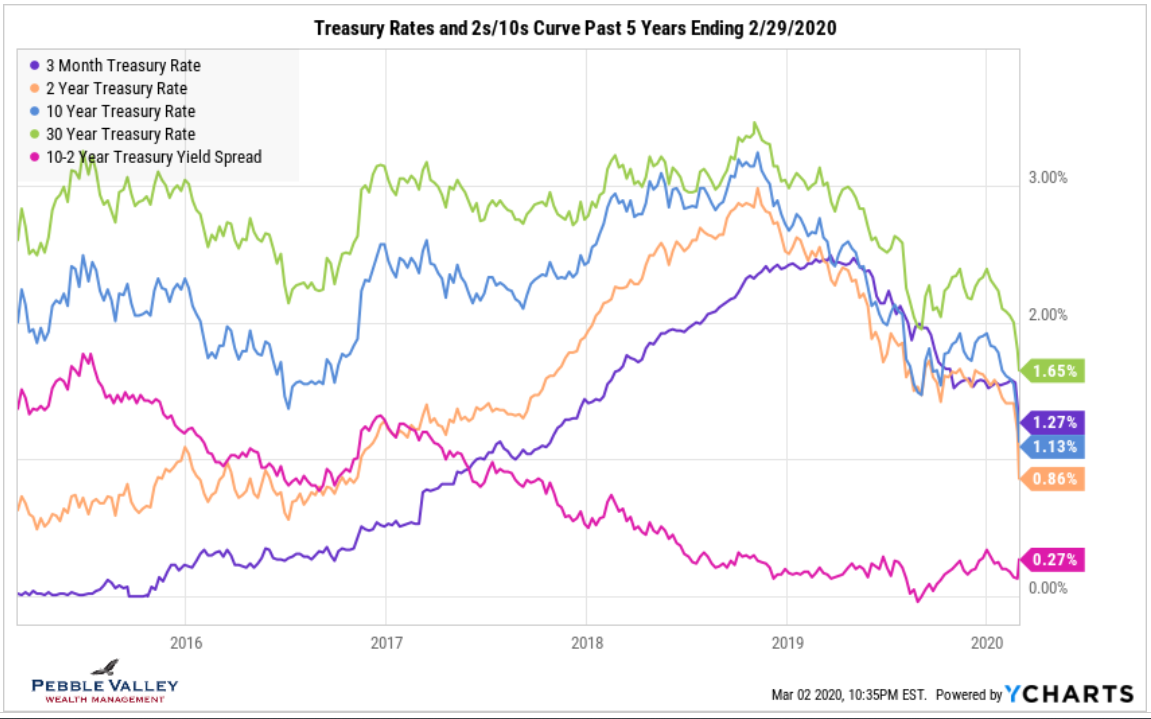

Not all markets were down. Bonds and some alternative funds historically hold up quite well in this environment when the flight to safety kicks in. This time is no different. And recall as bond prices go up the yield goes down. The 10-year treasury rate fell below 1.20% this month to all-time lows; the 30-year fell below 1.70%. If you had the courage to hold long treasury bonds with rates already quite low – I do not – you saw a +17% YTD gain. That’s right… for bonds… over two months. Higher quality corporate bonds also had a solid return for two months of work but high yield was hit along with equities. REITs, which normally do well with bond prices rising and rates falling, acted more like equities this month, dragging them down YTD. Commodities held up relatively well – I said relative – but much damage was done in January. Note the energy-heavy GSCI Commodity index is down over 18% YTD. The other thing up in this market is volatility. That can be a bad thing for equity prices but a good thing if willing to sell volatility – and take the resulting risks. There are many risks involved so be careful.

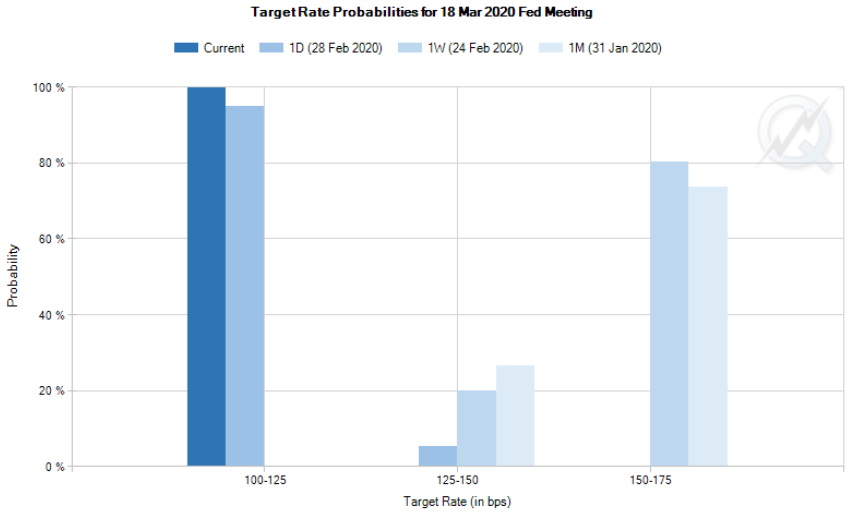

The next Fed meeting concludes March 18th. After the last Fed meeting, it was expected the Fed would be on hold with Fed Funds rate at 1.50% - 1.75% and slowly reduce the buying of short-dated paper as the repo market no longer shows stress. However, with the coronavirus impact the market is pricing in a 100% probability Fed cut of 0.50% at or before the next meeting. This strikes me as a bit premature for this supply-driven shock to the economy but Central Banks like to spread foam on the runway.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com