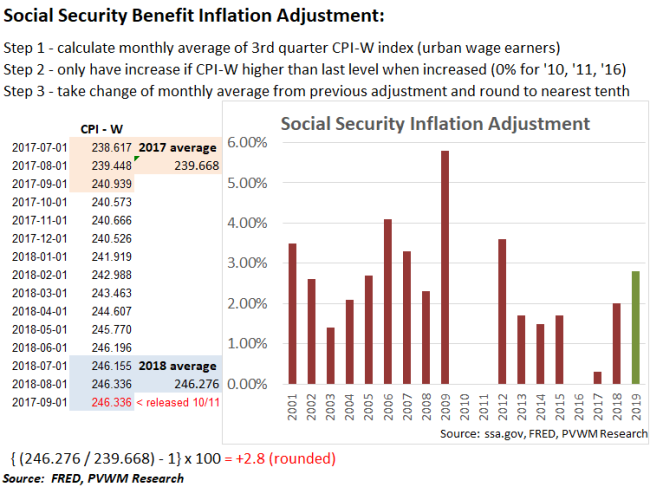

2019 ESTIMATED Social Security Inflation Adjustment: 2.8%

The fall season brings us changing leaves, harvest, football - and the inflation adjustment for Social Security benefits and maximum salary subject to Social Security payroll taxes. The final CPI-W data point will be released October 11th but with 2 of the 3 data points known, an early estimate can be calculated. Retirees will be happy to learn the approximate increase for benefits will be around 2.8%, the highest since 2012. Unlike last year when most of the increase went to pay for catch-up Medicare premiums for many (due to the hold-harmless clause), this increase will actually be seen in the net benefit hitting bank accounts.

The graphic below shows the steps to calculate the inflation adjustment and the recent history of actual increases. The approximation assumed the September CPI-W data point will not increase. It would take a relatively large monthly increase of 0.30% to push to a 2.9% increase but only a small -0.05% decrease to drop down to 2.7%.

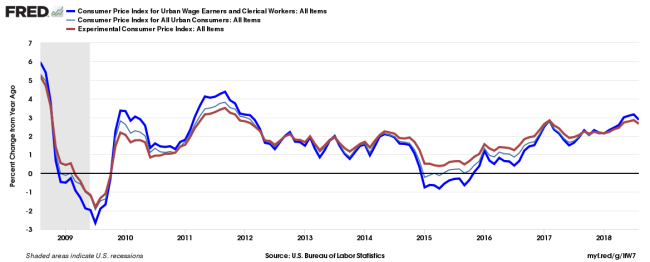

Note the inflation index used for Social Security is the non-seasonally adjusted index for wage earners (CPI-W), not the more common seasonally adjusted index for all urban consumers (CPI-U) used in regular inflation reports reported in the media. There is also an experimental inflation index called CPI-E which captures the common basket of goods and services for those age 62+. There are years when these different indices can diverge significantly, but this year isn’t one of them. The graph below shows these indices over the past ten years. The common CPI in the news every month is the light gray line and is right on top of CPI-W recently.

For those working and paying into Social Security (6.2% payroll tax for SS on wages up to $128,400 for 2018), the estimated increase in wages subject to this tax is based on a different index – the ‘national average wage index’. I do not have an estimate based on this index at this time. Recall there is an additional 1.45% payroll tax for Medicare that is applied to all wages (not capped), plus an additional 0.9% on earnings above $200,000 for individuals and $250,000 if married filing jointly (NOT indexed to inflation). Your employer also pays these taxes (or you if self-employed), except the extra 0.90%. For those interested in a deeper dive, see my blog post on Social Security and Medicare Financial Overview.

Watch for the final inflation adjustments after the October 11th CPI-W reading. In the meantime, be assured it will be another solid increase in your gross benefit and even your net benefit after Medicare premiums are deducted.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com