Summary of New Tax Bill and Key Changes

The tax law was passed by Congress and signed into law in late December. The changes impacted both individual and corporate taxes. This blog post provides an update – and convenient reference - from my mid-November post when differences between the House and Senate plan were still being considered. The focus here will be on the impact to individuals including a couple examples; the corporate changes are briefly mentioned but not a focus. For my clients, this summary is very similar to what I provided back in late December.

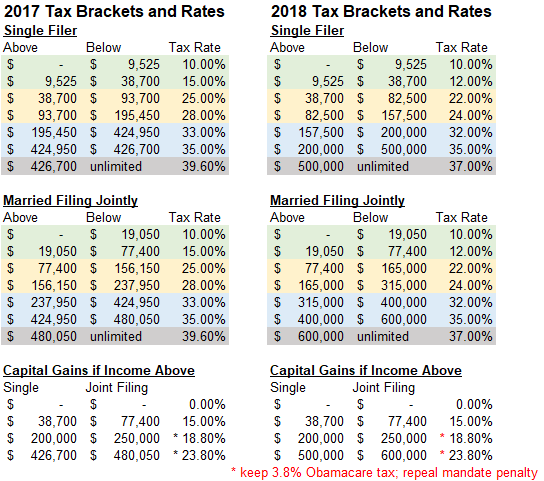

New income brackets and marginal rates

The new bill kept the same number of income brackets but raised the income thresholds for some brackets and lowered the marginal tax rate for all but the lowest bracket. The capital gains rate remained the same – including a 0% rate for the first two income brackets – but the top income bracket threshold was raised. The extra 3.8% Obamacare tax for incomes over $200k / $250k also remains but the mandate penalty was repealed.

Higher Standard Deductions and Itemized Deductions Limits

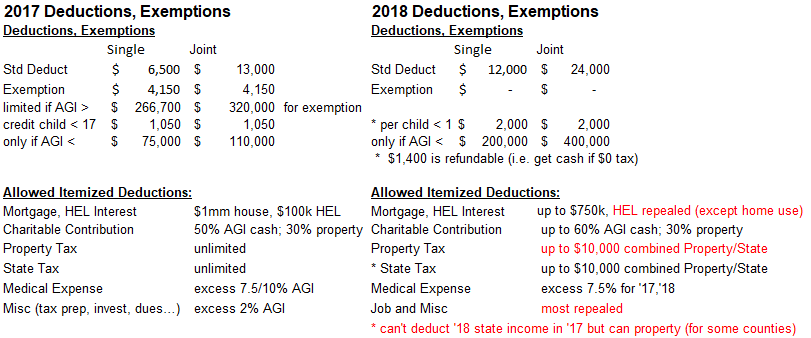

The change to exemptions and deductions is probably the area of biggest change for most tax filers. The impact will vary between individuals depending on the type and amount of itemized deductions and the amount of exemptions claimed.

The first major change is the repeal of the exemption amount per person in exchange for a higher standard deduction – $12,000 for single filer; $24,000 for Joint. This is good news if you had low exemptions or income was too high to claim anyway; not so good if a larger family. As an offset, the child tax credit (under age 17, lower AGI limits) is raised by $600.

The other more controversial change involved which itemized deductions remain and the dollar limit. For some tax filers, the higher standard deductions will make itemized deductions a moot point. Recall if total itemized deductions don’t exceed the standard deduction, the standard is used and move on. For those whose itemized deductions are above the new higher standards, there are certain deductions that will either be eliminated or capped. The new standard vs. itemized deductions will likely be the key driver of whether you pay more or less taxes.

Other Individual Tax Changes, Estate Tax and Corporate Tax

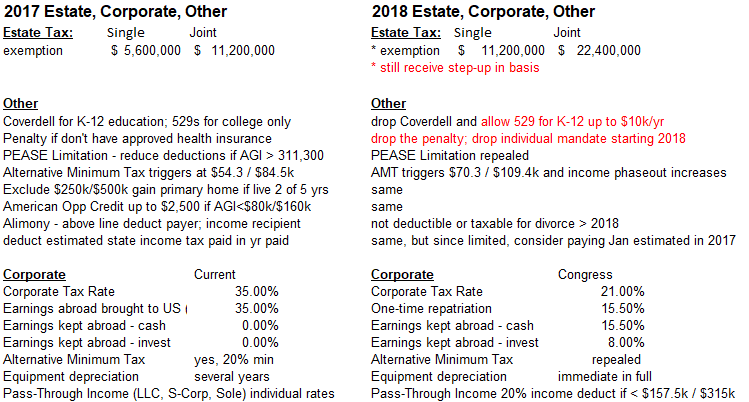

Here is a brief summary of other notable changes:

- Saving for education - Coverdell accounts (low amounts, pay for K-12) will be eliminated but the 529 Savings accounts will allow for K-12 qualified expenses, capped at $10,000/year.

- Student loan interest REMAINS allowed as a ‘page 1’ deduction (not part of itemized).

- The residential capital gains exemption requirement - live in the residence for 2 of last 5 years REMAINS (initial proposal had raising to 5 out of last 8 years).

- Alimony payments are not deductible or taxable for divorces after 2018.

- The federal estate tax exemption amount will be doubled to $11.2mm for single or $22.4mm for a couple. The step-up in basis also remains. You still need to check if your state has an estate tax and if so, the much lower exemption amount.

- Corporate tax rate was lowered from 35% to 21% to be more competitive with the global trading partners.

- One-time repatriation of overseas profits lowered which may result in proceeds coming back to US.

- Equipment depreciation in full; pass-through income limited to companies involved in ‘non-service’ fields.

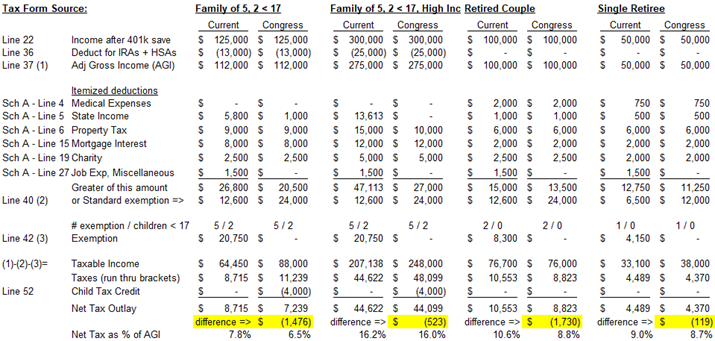

Impact on taxes paid - NOT INTENDED TO BE EXACT TAX CALCULATION OR TAX ADVICE

You may be wondering how these changes may impact your own taxes. For a high-level estimate (not accounting preparation or advice!), grab last year’s Form 1040 (first two pages) and Schedule A (itemized deductions) and run your numbers through the table below in place of one of the hypothetical families. The ‘taxable income’ should then be run through the tax brackets above. Notice the impact the higher income thresholds have on capturing the child tax credit for the ‘family’ examples. ‘Retirees’ may find the standard deduction is higher than itemizing. Making charitable contributions directly from IRAs will become even more valuable for those retirees.

I hope this summary of the tax law changes is helpful in understanding how it will impact your tax situation and tax planning strategies.

Posted by Kirk, a fee-only financial advisor who looks at your complete financial picture through the lens of a multi-disciplined, credentialed professional. www.pvwealthmgt.com